Analytics and statistics overview of popular blockchains

Compare leading blockchains through onchain stats. This Blockscout-powered guide highlights real metrics across Ethereum, Base, Optimism, Ink, Soneium, Unichain and more.

Blockchain ecosystems have undergone rapid evolution over recent years, becoming integral to a diverse range of industries and applications. From financial services to gaming and sustainability initiatives, blockchains provide decentralized, secure, and efficient solutions to complex problems. Each blockchain platform brings distinct advantages and functionalities, uniquely positioning itself to address specific market needs and user preferences.

In this introductory overview, we include prominent blockchains, as well as notable standalone and integrated rollup chains. Utilizing detailed metrics from Blockscout statistics, we provide clear and insightful comparisons that highlight the distinct strengths and real-world applications of each blockchain. Chains covered in this overview include:

Ethereum

Ethereum, the pioneering Layer 1 blockchain, remains the gold standard for security, decentralization, and developer adoption. Ethereum supports extensive smart contract usage and decentralized applications, providing the ground level in the world of Decentralized Finance (DeFi), NFTs, and beyond.

Ethereum boasts robust security thanks to its extensive validator network, with over 1.09 million validators ensuring maximum decentralization. It also offers the most mature ecosystem with the deepest liquidity pools, widespread adoption by developers and enterprises worldwide (with over 79.8 million smart contracts deployed as of late July 2025, the highest of any chain), and the highest total value locked (TVL), reflecting strong user trust and significant financial activity.

With the recent Pectra upgrade increasing throughput to approximately 420 TPS for Layer 2 solutions, Ethereum continues to serve as the settlement layer for the entire ecosystem.

Arbitrum

Arbitrum is a leading Layer 2 rollup solution that competes strongly with Optimism. It provides an impressive transaction throughput of 37.25 transactions per second (TPS) and can reach peak performance levels of 1,105 TPS, all while maintaining low transaction costs.

Arbitrum maintains the largest TVL in the Ethereum Layer 2 ecosystem while hosting the most mature DeFi protocols with over $100M daily DEX volume. It also features an advanced fraud-proof system that ensures maximum security, alongside EVM equivalence, which allows seamless Ethereum compatibility for developers migrating existing applications.

Arbitrum has gained substantial adoption, particularly within DeFi and gaming projects, making it a significant player in the blockchain ecosystem.

Optimism

Optimism, an Ethereum Layer 2 rollup, significantly reduces transaction fees and increases throughput while inheriting Ethereum's robust security. It remains popular among DeFi projects due to its efficient architecture. Many new chains are using Optimism as the underlying technology to support their chains, resulting in the Superchain network. Interoperability between these chains in the future will result in faster speeds for users and applications.

In May 2025, Optimism activated the Isthmus hardfork, integrating features from Ethereum's Pectra upgrade into the OP Stack and the broader Superchain, making it the first L2 ecosystem to adopt cutting-edge Ethereum improvements.

Optimism has led the way with the Superchain through its OP Stack technology, now supporting over 29 chains, including Base, Ink, Soneium, and Worldchain. The combined Superchain handles 36.4% of all Layer 2 transactions, with $16.57 billion in TVL across all OP Stack chains. Essentially, while other L2s compete for users and TVL, Optimism has positioned itself as the infrastructure foundation that other successful chains build upon.

Base

Base, developed by Coinbase, is an Optimism-based Layer 2 solution. The network has become a transaction volume leader, processing 98.13 TPS with peaks reaching 1,267 TPS. Base's current TPS is 98.13 transactions per second, and its maximum TPS is 1,267 transactions per second.

As of 2025, Base processes the highest daily transaction volume among major L2s, surpassing Polygon to become the dominant chain for ERC-4337 UserOps. Through April 2025, Base processed over 3 million UserOperations weekly, representing roughly 87% of total weekly UserOps, marking it as the top choice for account abstraction deployments and gasless smart wallet usage.

Base's unique strength lies in its direct access to Coinbase's 100+ million user base and seamless fiat on-ramps. The network prioritizes utility over speculation, with no native token; instead, it optimizes for high-throughput applications and gasless transaction capabilities through smart wallet technology.

Unichain

Unichain is emerging as a prominent player in the decentralized finance space, offering a multichain liquidity layer that bridges assets and trading activity across Optimism and its Superchain ecosystem. It focuses on unified user experience, gas-efficient trading, and seamless integrations with Layer 2 protocols.

Unichain launched in 2025 as the most decentralized L2 from day one, achieving Stage 1 rollup status from the very beginning.

Unichain offers impressive onchain stats, such as quick transactions with block times of just 1 second. It achieves effective block times of 250 milliseconds using Trusted Execution Environment (TEE) optimization. This approach cuts costs by 95% compared to the Ethereum mainnet and offers advanced protection against Miner Extractable Value (MEV) issues, making it suitable for institutional-level DeFi operations.

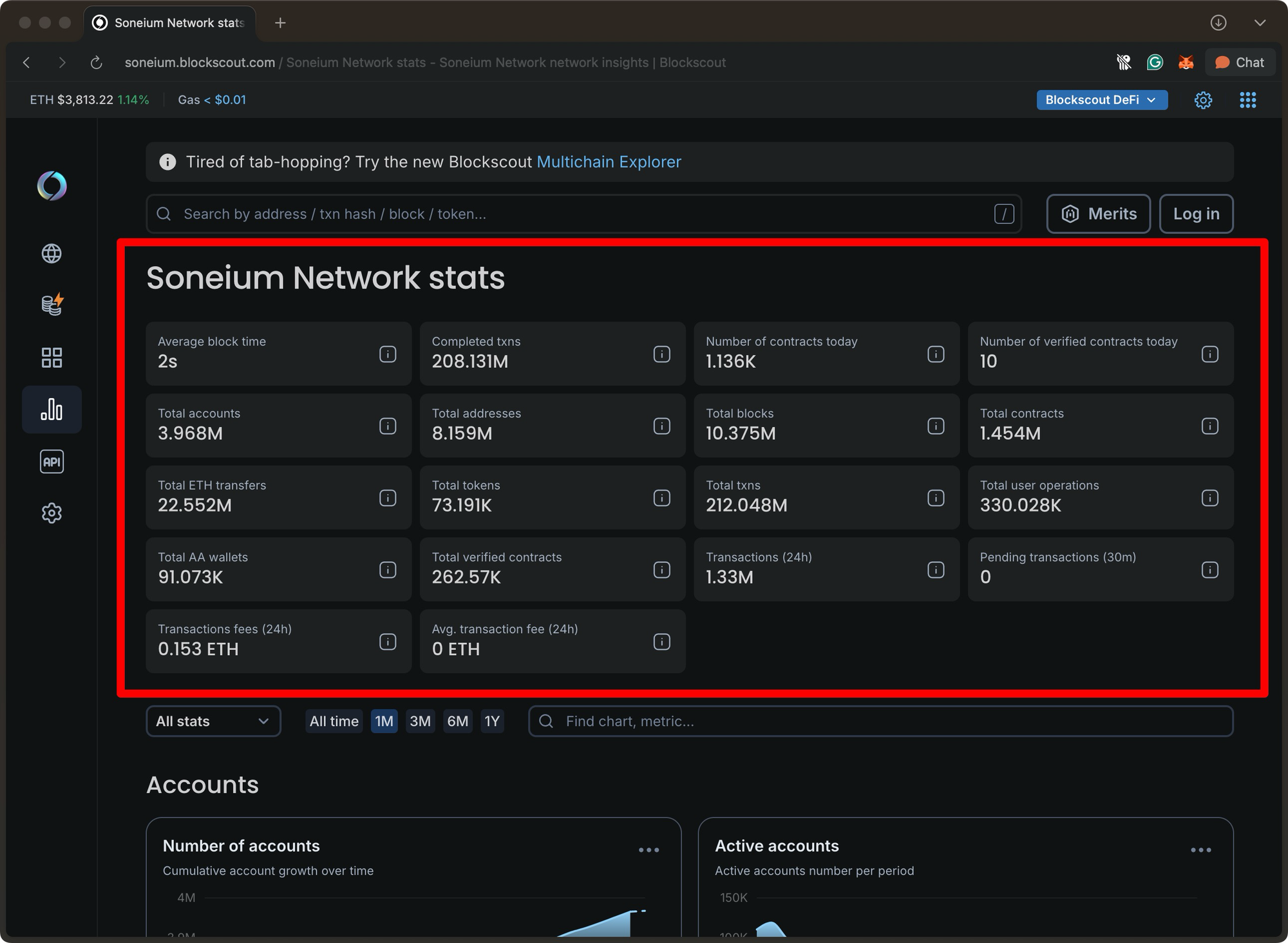

Soneium

Soneium is a Layer 2 blockchain created by Sony Block Solutions Labs, a collaboration between Sony Group and Startale. Designed to bridge Web2 and Web3, utilizing Sony's extensive experience in entertainment to focus on gaming and related sectors.

The platform features optimized infrastructure to establish enterprise partnerships through Sony's global network. Soneium offers DeFi tools for creators to effectively monetize digital content in the blockchain ecosystem, merging traditional entertainment with blockchain technology and opening new opportunities for creators and gamers.

Worldchain

World Chain introduces proof-of-personhood as a core feature, emphasizing verified human transactions over bot activity. By implementing a human transaction priority that reduces bot congestion and offering free gas allowances for verified users, it establishes an identity-first architecture that supports entirely new application types.

Over 10 million individuals across 160 countries have created a World ID along with a compatible wallet. These users have successfully completed a total of 75 million transactions using this system.

Ink

Kraken's Ink stands out within Optimism’s ecosystem by prioritizing privacy-focused decentralized applications, addressing critical data confidentiality needs while maintaining efficient transaction processing.

Launched in December 2024, Ink now processes over 550,000 daily transactions and has seen peaks of nearly 5,700 active contracts in a single day. The network has surpassed 75 million total transactions and maintains approximately 70,000 daily active addresses

As the only exchange-backed DeFi-focused L2, Ink leverages Kraken's institutional credibility to bridge CeFi and DeFi. The network received 25M OP tokens (~$58M value) and focuses on security, aggregation, and automation for sophisticated DeFi users.

Celo

Celo is notable for its focus on mobile accessibility, which enhances global financial inclusion efforts. It facilitates seamless and cost-effective financial transactions directly on smartphones, making it easier for users to engage with financial services.

Celo revolutionizes accessibility through phone number wallet addresses, simplifying user onboarding and supporting multi-stablecoin operations (cUSD, cEUR, cREAL), and providing global accessibility specifically targeting underbanked populations worldwide. As of writing, looking at the onchain stats we already see over 883M transactions across nearly 12M accounts.

Gnosis

Gnosis operates as an independent Layer 1 blockchain, specializing in secure and community-focused decentralized applications and governance solutions. It emphasizes the importance of security and community involvement in the development and operation of its ecosystem.

Gnosis Chain supports over 200,000 permissionless validators, second only to Ethereum, offering robust decentralization and security. While transaction volume peaked at over 5.6 million per day in late 2023, current daily throughput remains in the hundreds of thousands to low millions, with ultra-low, stable fees consistently under $0.01.

Conclusion

In a rapidly expanding ecosystem of Layer 1 and Layer 2 blockchains, no single solution fits all use cases. Instead, each chain brings targeted innovation, whether it's Ethereum's unmatched security and decentralization, Base's dominance in account abstraction, or Celo's push for global financial access via mobile. As we've seen through Blockscout's data, these networks complement one another, offering developers and users a robust landscape of options.

By understanding the strengths and evolving metrics of each chain, stakeholders can make more informed decisions about where to build, invest, or explore. Blockscout continues to play a key role in enabling this visibility, helping both technical and non-technical users interact with blockchain ecosystems transparently and effectively.