Understanding Gas Fees Across EVM Chains

Gas fees are one of the more complicated aspects of using a blockchain. Learn how gas works on EVM-compatible chains, why costs differ between networks, and how to read gas data correctly using Blockscout.

Gas fees are one of the more complicated aspects of using a blockchain. Numbers like “21,000 gas used” or “50 gwei” are associated with transactions in block explorers, but their meaning is not always obvious. It can also be frustrating to see the same transaction cost fifty cents on one network and fifteen dollars on another.

At a basic level, gas fees are the costs associated any action on a blockchain. Sending tokens, minting NFTs, or interacting with smart contracts all require gas. The more complex the interaction, the more gas is needed. Gas is the fuel that powers the network. Without it, transactions cannot be processed.

This article explains how gas works on EVM-compatible chains, why costs differ between networks, and how to read gas data correctly using Blockscout.

What Gas Actually Measures

On EVM chains, gas measures computational work. Every operation in a transaction has a predefined gas cost.

Simple actions like transferring tokens require relatively little gas, while complex smart contract logic consumes much more. A native token transfer (for example sending ETH from one address to another), requires 21,000 gas units as the base fee. This is the standard minimum amount of gas for any operation.

Gas units measure the amount of work required to process the transaction. The final cost depends on:

- The number of gas units required for the transaction. On Ethereum, this includes a base fee + a priority fee which can be sent by the user to incentivize validators to prioritize their transactions.

- The cost per gas unit, which can vary based on network conditions (when the network is more congested the base gas fees go up, when blocks are less full, they go down).

- The price of the native gas token.

Why Gas Fees Exist

Gas fees serve several important purposes.

- Validator incentives. Validators are the nodes run by individuals and collectives that verify transactions and add them to the blockchain. Gas fees reward validators for their work, encouraging honest participation.

- Network security. Because every transaction has a cost, it becomes expensive for malicious actors to flood the network with useless transactions.

- Block space allocation. When many users want to transact at the same time, fees rise as users compete for inclusion. This market-driven mechanism ensures that block space goes to those who value it most at that moment.

Breaking Down Gas Components

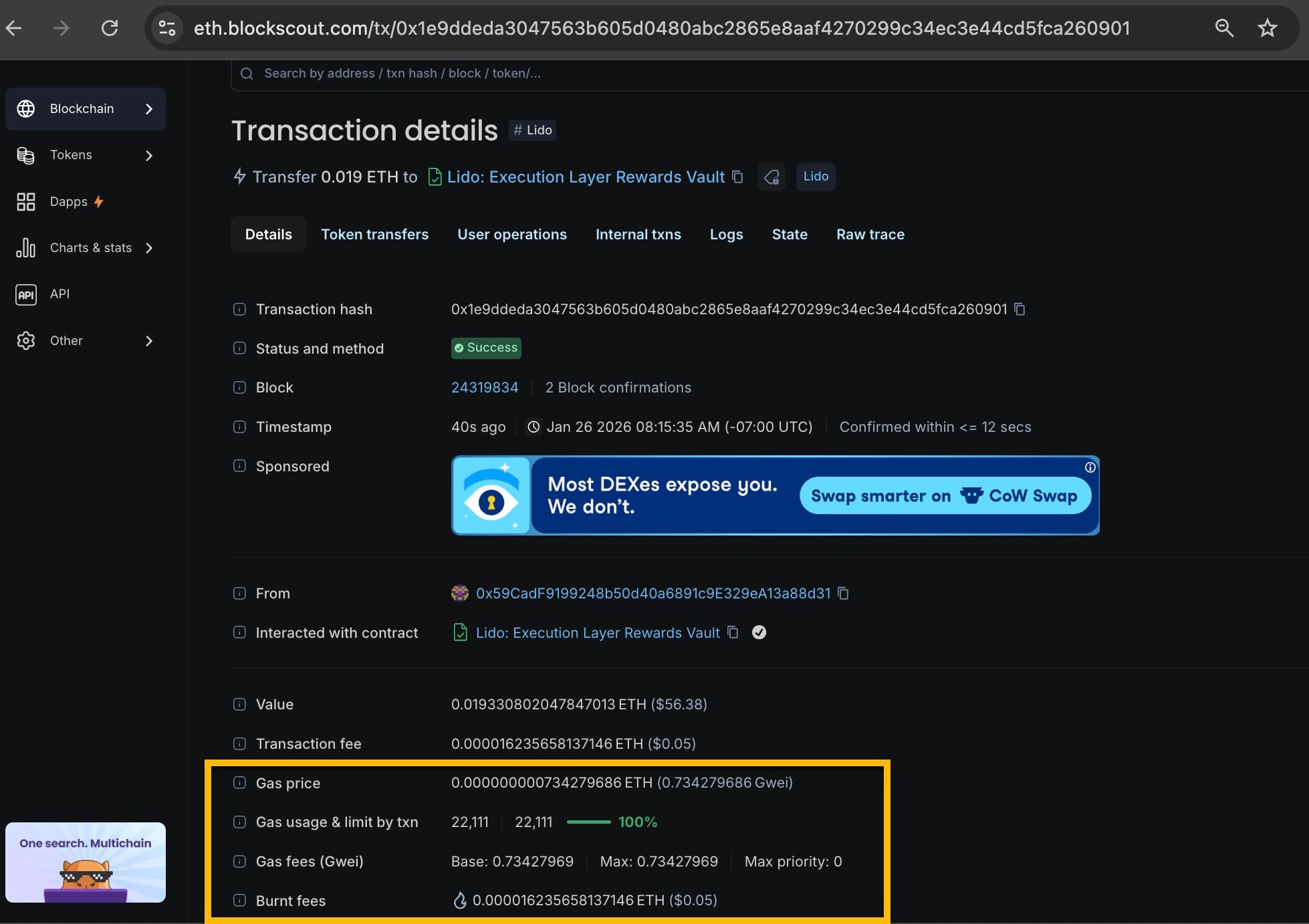

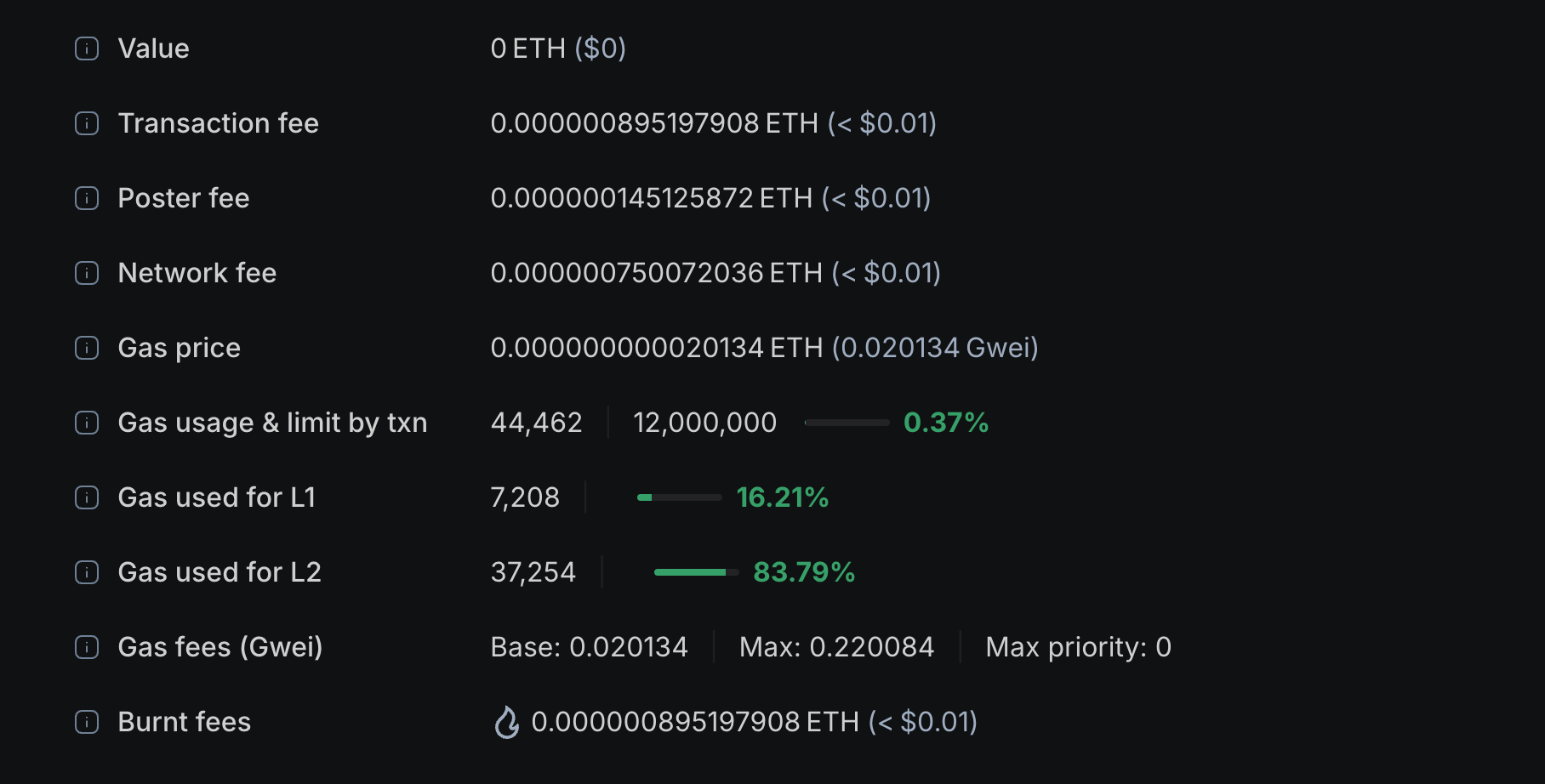

When viewing a transaction in Blockscout, you will see several gas-related fields. Each one contributes to how fees are calculated.

Gas Price and Gwei

Gas price is the cost per unit of gas you are willing to pay to send a transaction. It is usually quoted in gwei, which is a small denomination of the chain’s native token. On Ethereum, one gwei is one billionth of an ETH.

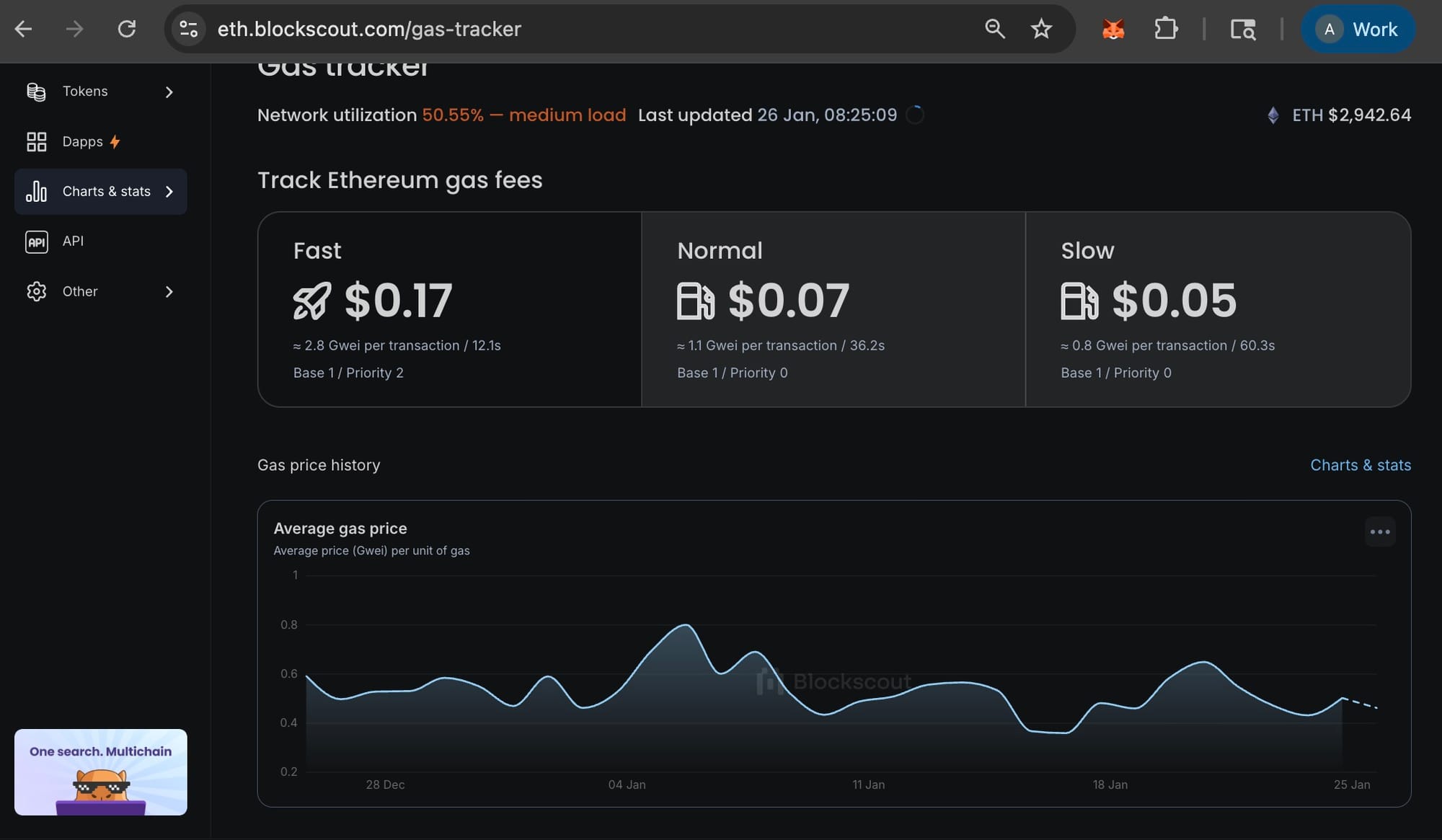

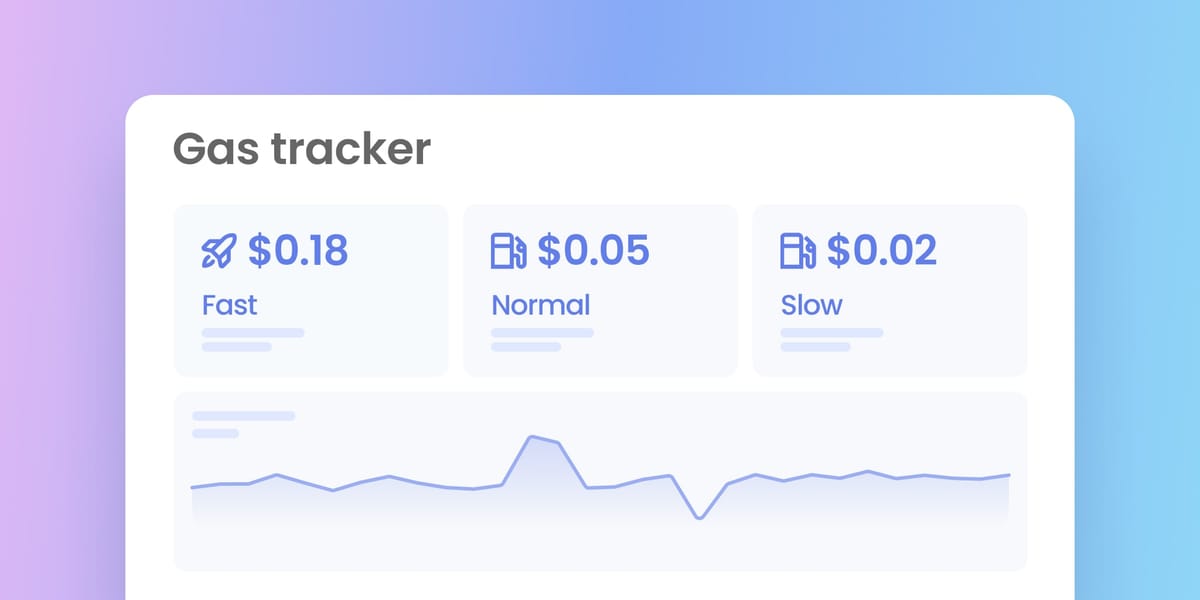

Setting a higher gas price leads to faster inclusion on the blockchain, as validators are more apt to include these first. The Blockscout gas tracker shows current fee prices for fast, normal, and slow inclusion.

The total transaction fee is calculated by multiplying gas used by the effective gas price. For example, a transaction that uses 30,000 gas with a gas price of 15 gwei would cost 450,000 gwei, or 0.00045 ETH.

Gas Limit

The gas limit is the maximum amount of gas you allow your transaction to consume. It functions like a spending cap.

If a transaction needs 50,000 gas but the limit is set to 30,000, it will fail. Even then, you still pay for the computation performed before the failure. Setting a higher limit than necessary does not increase your cost because you only pay for the gas actually used.

Most wallets estimate gas limits automatically. Manual changes are mainly useful for advanced or unusual contract interactions.

Gas Used

Gas used shows the actual amount of gas consumed by the transaction. In Blockscout, this appears as a number and a percentage of the gas limit.

If a transaction uses much less gas than its limit, the estimate was conservative. If it uses nearly all of it, the transaction either ran very efficiently or came close to failing.

Base Fee and Priority Fee

After EIP-1559, most EVM chains adopted a split fee model. The base fee adjusts automatically based on network demand. When blocks are more than half full, the base fee increases. When they are less full, it decreases.

The base fee is burned (burnt fees) rather than paid to validators. This mechanism improves fee predictability and can reduce token supply over time.

The priority fee, often called a tip, is paid directly to validators. It incentivizes them to include your transaction more quickly. During quiet periods, a small priority fee is enough. During times of heavy usage, higher tips are often required to ensure transactions are included.

Why Gas Costs Vary Between Chains

A standard token transfer uses ~ the same amount of gas on every EVM chain. The reason costs vary comes down to external factors.

Network Demand

Ethereum mainnet processes a very high volume of transactions with limited block space. This can competition and drives up gas prices, although they have been trending down recently. Other EVM chains and Layer 2 networks often have more available capacity relative to demand, which keeps fees lower.

Block Time and Capacity

Some chains produce blocks every few seconds, while others take over ten seconds. Faster block times usually increase transaction throughput and reduce competition for block space.

Native Token Value

Gas fees are paid in the native token of each chain. Ethereum uses ETH, Gnosis uses xDai, and others use their own tokens. Even if two networks show similar gas prices in gwei, the dollar cost can differ significantly because token prices vary.

How Gas Fees Work on Ethereum

On Ethereum, every transaction requires gas units for execution and a gas price set by the user. The total fee is the product of these two values.

Ethereum uses a dynamic fee model where gas prices change based on network activity. When demand is high, users must pay more to have their transactions included quickly. When demand drops, fees fall accordingly.

This model ensures efficient use of block space but can make fees unpredictable during busy periods.

How Gas Fees Work on Layer 2s

Layer 2 networks (Arbitrum for example) are designed to reduce gas costs while maintaining Ethereum-level security.

Arbitrum uses rollups, which bundle many transactions together and process them offchain. Only essential data and proofs are posted back to Ethereum. This reduces computational and storage load on Ethereum mainnet.

Gas fees on Arbitrum generally consist of two parts. The first is execution cost on the Arbitrum network itself, which is much cheaper than Ethereum mainnet. The second is the Layer 1 data cost, which covers the expense of submitting transaction data back to Ethereum. This cost is shared across all transactions in a batch.

Because of this structure, gas fees on Arbitrum are typically a fraction of Ethereum’s, even though they are still paid in ETH.

Reading Gas Data in Blockscout

Blockscout presents gas information consistently across all supported chains, making it easier to analyze and compare transactions.

Transaction Overview

The transaction page shows gas used, gas limit, and fee details. For modern transactions, base fee and priority fee are listed separately.

The gas used percentage is especially helpful. Values above 95 percent suggest that the gas limit was set efficiently or that the transaction barely succeeded.

Fee Calculations

Blockscout displays the total transaction fee in both the native token and in USD. This value is calculated using the effective gas price and the gas actually consumed.

Older transactions that use legacy pricing show a single gas price instead of a split fee structure.

Block and Network Analysis

Viewing a block in Blockscout shows how much gas was used relative to the block limit. Blocks that are consistently close to full indicate strong demand and usually correlate with higher gas prices.

Historical charts on Blockscout also help identify trends, such as lower fees during off-peak hours or spikes during major events.

Practical Tips for Managing Gas Costs

Understanding gas data allows you to make better decisions and avoid unnecessary expenses.

Timing transactions during periods of lower network activity can significantly reduce fees. Blockscout makes it easy to monitor recent gas prices and spot favorable windows.

If you aren't in a hurry, you can use a service like GasHawk which is integrated into Blockscout and predicts and executes at the lowest base fee over any time interval.

Developers can use Blockscout to review gas usage and identify inefficient contract logic. Unexpectedly high gas consumption often points to optimization opportunities.

Looking at recent blocks helps determine appropriate priority fees. When blocks are not full, minimal tips usually work. During congestion, higher tips become necessary.

Failed transactions still cost gas. Blockscout shows failure reasons, helping users avoid repeating costly mistakes like incorrect parameters or insufficient balances.

Why This Matters

Gas fees directly affect whether blockchain applications are practical. A DeFi strategy that works with low fees may become unusable when costs spike.

Understanding how gas works helps users choose the right chain for each task and helps developers build more efficient applications. Blockscout provides the transparency needed to understand what you are paying for and why.

As scaling solutions continue to evolve, tools like Blockscout remain essential. They bridge the gap between complex fee mechanics and real-world decision making, giving users clarity in an increasingly multi-chain ecosystem.