Confessions of a Block Explorer: What Really Happens Inside a Transaction

Learn how to read a blockchain transaction step by step on a block explorer. Understand transfers, NFT mints, swaps, bridges, gas fees, and contract interactions.

Most people interact with blockchain transactions every day without actually understanding what happened.

A transaction succeeds, fails, costs more than expected, or triggers a swap, mint, or bridge. The wallet shows a hash, the explorer opens, and suddenly you are staring at wall of numbers and meaningless words like gas limits, method calls, logs, and token movements.

Let's cross that wall and breakdown what it all truly means.

Once you know how to read a transaction properly, you can verify where your funds went, understand what a contract actually did, and spot unexpected behavior before it becomes a problem.

Your favourite block explorer then becomes one of the most powerful transparency tools in crypto.

This guide walks through how to read blockchain transactions line by line using Blockscout, starting with a simple ETH transfer and working up to NFT mints, swaps, and cross-chain bridges.

What You Will Learn

This walkthrough covers three progressively more complex transaction types:

1. Simple Transfers

How to read the most basic onchain action: one wallet sending native tokens (such as ETH) to another.

Example: a real transfer from one of Vitalik Buterin’s wallets to a Safe multisig.

2. Simple Contract Interactions

What it looks like when a transaction calls a smart contract instead of another wallet.

Example: the first user minting the Buff Badge NFT on Base.

3. Complex Contract Interactions

How multiple contracts, swaps, and bridges can occur inside a single user-initiated transaction.

Example: a Swapscout bridge from Polygon to Ethereum.

By the end, you will be able to open any transaction on Blockscout and understand exactly what happened, who interacted with whom, what moved where, and what your wallet or dapp is actually doing under the hood.

But First: What Do All These Tabs Mean?

When you open any transaction in Blockscout, you will see several tabs below the summary section:

For a simple ETH transfer, most of these tabs are empty. As you explore DeFi or NFT transactions, these tabs begin to fill with detailed data.

Blockscout Transaction Tabs Explained

| Tab | What It Shows | Why It May Be Empty |

|---|---|---|

| Details | Structured transaction metadata such as hash, block, and gas | Already summarized at the top |

| Token Transfers | ERC-20, ERC-721, or ERC-1155 token movements | No tokens involved |

| User Operations | ERC-4337 account abstraction user operations | Not a smart wallet |

| Internal Txns | Contract-to-contract ETH movements | No contracts executed |

| Logs | Decoded contract events | No contract called |

| State | Balance and storage diffs | Developer-focused |

| Raw Trace | Opcode-level execution trace | Debugging only |

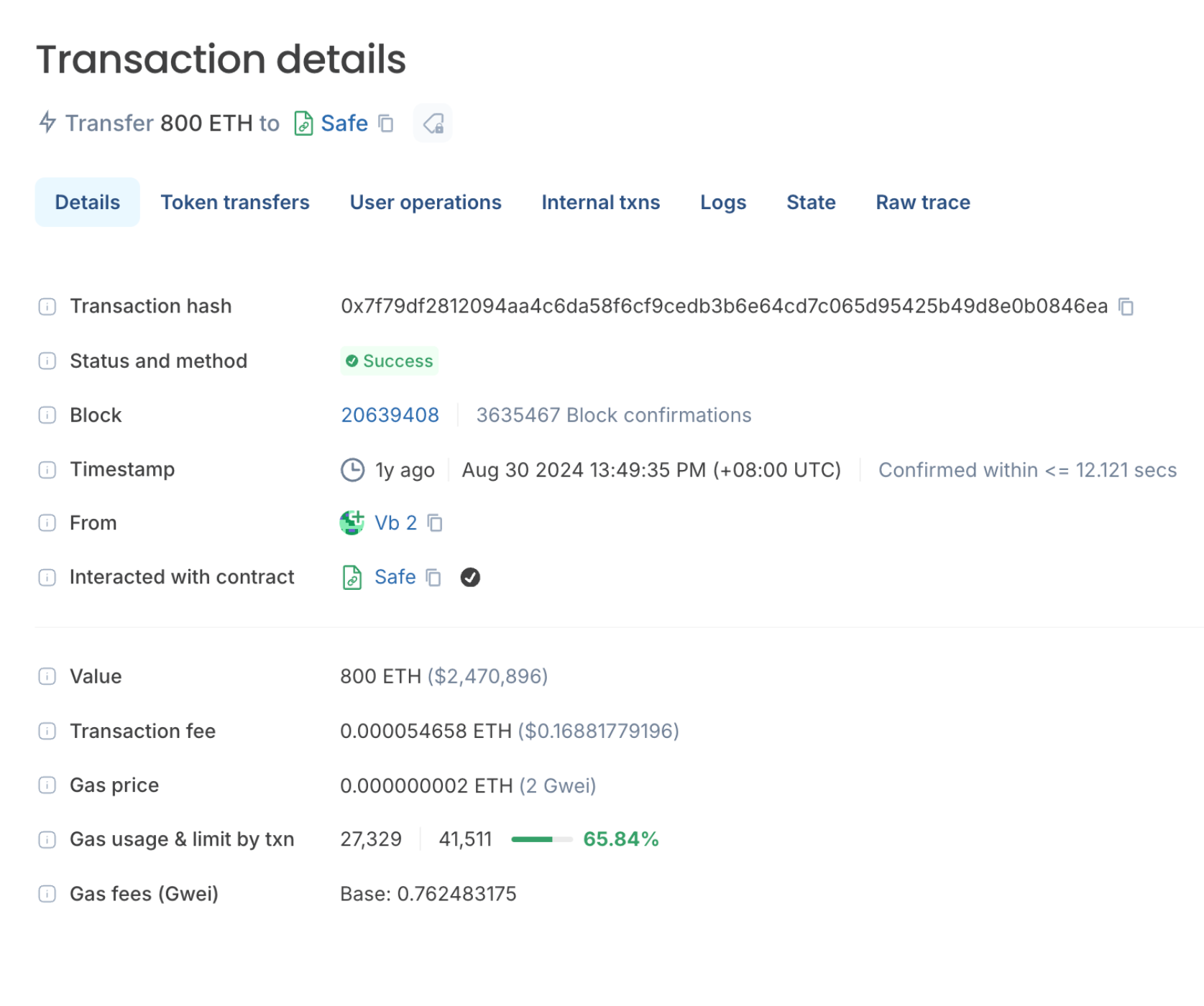

Example Simple Transfer: Vitalik Buterin’s 800 ETH Transfer to a Safe Multisig

Transaction hash

0x7f79df2812094aa4c6da58f6cf9cedb3b6e64cd7c065d95425b49d8e0b0846ea

About This Transaction

On August 30, 2024, one of Vitalik Buterin’s known wallets (commonly labeled “Vb 2”) sent 800 ETH (approximately $2.47 million) to a Safe multisignature wallet.

This was a plain ETH transfer, the simplest form of blockchain transaction. However, because the sender was Ethereum’s co-founder and the amount was large, it drew attention across crypto media and onchain analytics.

What Is a Safe Multisig?

A Safe Wallet (formerly Gnosis Safe) is a multisignature smart contract wallet used by teams and high-value holders.

Instead of a single private key controlling funds, a Safe requires multiple approvals, such as two out of three signatures, before funds can move. This reduces the risk of loss from compromised keys or user error.

In this case, the transfer is commonly interpreted as a security move rather than a sale.

Line-by-Line Transaction Reading

Transaction Details

Transfer 800 ETH to Safe

This simple AI summary explains what sort of transaction you are looking at in simple terms. In this case, direct native ETH transfer

Transaction Hash

A unique identifier for this transaction on-chain. It functions like a global receipt that anyone can verify.

Status and Method

Status: Success

Method: None

Native ETH transfers do not call a contract function. If this were a contract interaction, the method name would appear here.

Block and Confirmations

Block: 20,639,408

Confirmations: 3,634,757

Each Eth block groups transactions together. The confirmation count shows how deeply this transaction is buried in the chain, making it effectively irreversible.

Timestamp

Confirmed within 12 seconds, matching Ethereum’s average block time.

From

0x1Db3439a222C519ab44bb1144fC28167b4Fa6EE6

Label: Vb 2

This is an externally owned account (EOA), not a smart contract.

To

0xfEB016D0D14AC0Fa6d69199608B0776d007203B2

Label: Safe (contract)

Blockscout detects this as a smart contract wallet.

Value

800 ETH (~$2.47M)

This is the exact amount transferred.

Transaction Fee

0.000054658 ETH (~$0.17)

Fee equals gas used multiplied by gas price.

Gas Price

2 Gwei

A low gas price, indicating low network congestion.

Gas Usage and Limit

Used: 27,329

Limit: 41,511

Usage: 65.84%

Blockscout visualizes this so users can see whether the gas limit was overestimated.

Gas Fee Breakdown (EIP-1559)

- Base fee: 0.762483175 Gwei (burned)

- Priority fee: 1.237516825 Gwei

- Total: 2 Gwei

You can check current gas metrics using the ETH Gas tracker.

Contract Interactions

After understanding a simple transfer, we can move to the next level: contract interactions.

These occur when the destination address is a smart contract. This is where the blockchain shifts from behaving like a ledger to behaving like software.

How Contract Interactions Differ

| Field | Simple Transfer | Contract Interaction |

|---|---|---|

| To | Wallet address | Smart contract |

| Value | ETH transferred | May be zero |

| Input data | Empty | Encoded call data |

| Logs | Empty | Populated |

| Method | None | Function name shown |

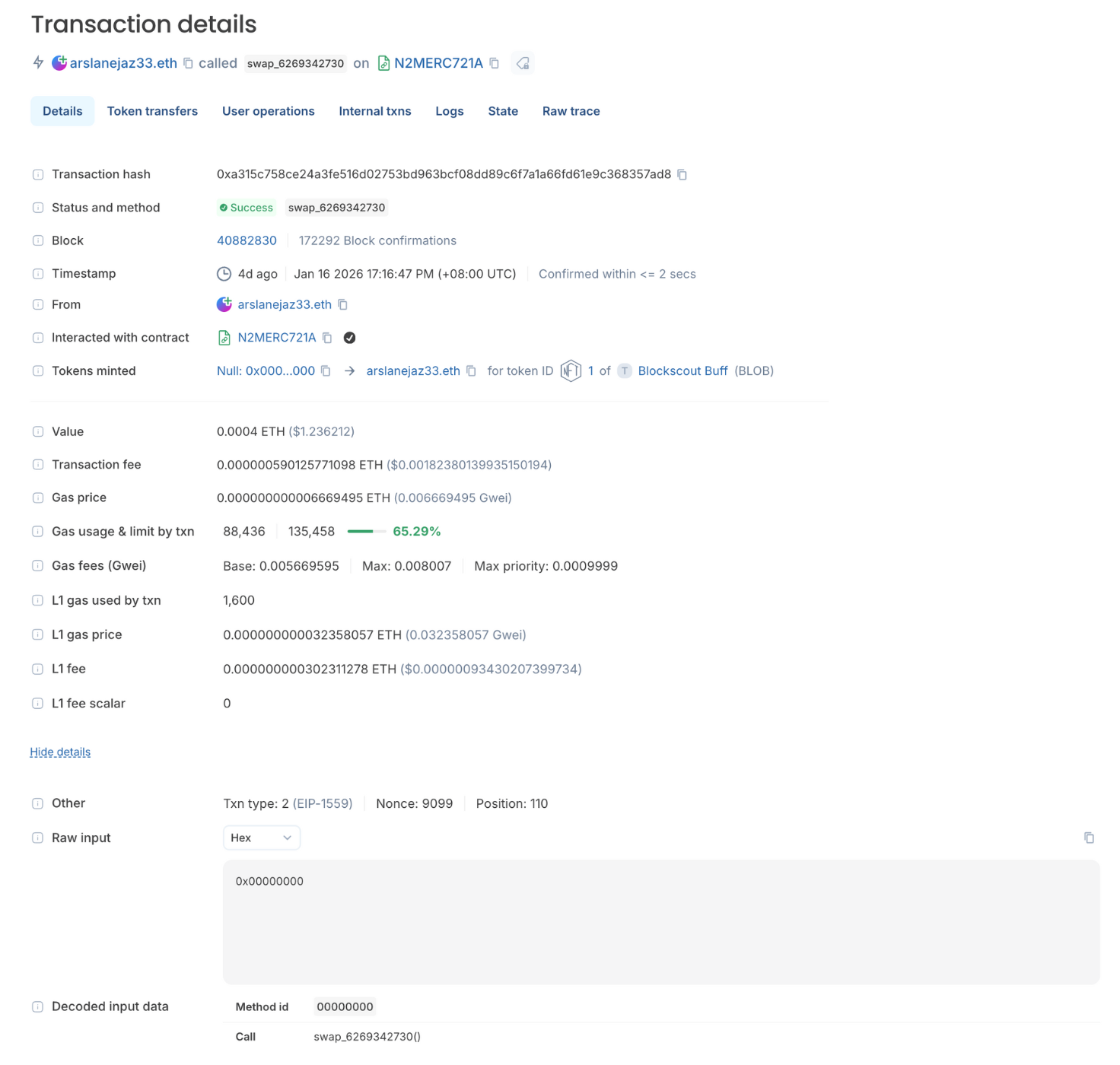

Example Simple Contract Interaction: Minting NFT

Transaction hash

0xa315c758ce24a3fe516d02753bd963bcf08dd89c6f7a1a66fd61e9c368357ad8

About This Transaction

This transaction shows the first user minting the Blockscout Buff Badge NFT on Base, an Ethereum Layer 2 rollup network.

Unlike a simple wallet-to-wallet transfer, this transaction calls a smart contract that executes logic onchain. In this case, the logic creates a new NFT and assigns ownership to the user’s wallet.

This example is useful because it demonstrates:

- A real ERC-721 mint

- Decoded contract data in Blockscout

- How Layer 2 fees differ from Ethereum mainnet

- How NFT creation is represented on-chain

Line-by-Line Transaction Reading

Transaction Details

arslanejaz33.eth called swap_6269342730() on N2MERC721A

This summary tells us that the user did not send funds to another wallet, but instead invoked a function on a smart contract. In this specific case, the function executed the logic required to mint a Blockscout Buff Badge NFT.

Even though the function name looks generic, Blockscout correctly classifies this as a contract interaction rather than a simple transfer. This is the key distinction that explains why additional tabs like Tokens Minted and Logs are populated for this transaction.

Transaction Hash

This is the permanent onchain identifier for the mint. Anyone can use this hash to independently verify when the NFT was created, which contract minted it, and which wallet received ownership.

Status and Method

Status: Success

Method: swap_6269342730()

A successful status confirms that the contract executed without reverting. The method name shown here is the exact function defined in the contract code that handled the mint.

For NFT contracts, function names are developer-defined and do not need to follow a standard naming convention. What matters is that the resulting events and token transfers confirm an NFT creation.

Block

Block: 40,882,830

Confirmations: 172,292

This transaction was included in a finalized Base block and has accumulated a high number of confirmations. On a Layer 2 like Base, confirmations accrue quickly, reinforcing that the mint is settled and irreversible.

Timestamp

The confirmation time is in line with Base’s average block time. This illustrates one of the main benefits of Layer 2 networks: near-instant transaction finality compared to Ethereum mainnet, even for contract interactions like NFT mints.

From

The "arslanejaz33.eth" is a human-readable ENS name representing the user’s externally owned wallet. Domain names like ENS, or InfinityName for example, resolve to standard 0x addresses but are easier for humans to read and verify.

To

N2MERC721A contract

This is the verified smart contract that created and manages the Blockscout Buff NFT collection.

Blockscout tags the recipient as “Interacted with contract”, confirming that this was a contract call rather than a wallet-to-wallet transfer.

Tokens Minted

This section summarizes what happened inside the contract in plain language.

Here is how to read it:

- Null (0x000…000) indicates token creation. In ERC-721 standards, a mint event uses the zero address as the sender.

- arslanejaz33.eth is the recipient and new owner of the NFT.

- Token ID 1 means this was the very first NFT minted in this collection.

- Blockscout Buff (BLOB) is the name and symbol of the NFT collection.

This single line confirms that:

- the mint function was executed,

- a new NFT was created on-chain,

- and ownership was assigned to the user.

Contract Details: What “N2MERC721A” Means

N2MERC721A is the verified contract name.

- ERC721A is a gas-optimized NFT standard developed by Azuki’s engineers to reduce minting costs, especially when multiple NFTs are created in one transaction.

- N2M refers to the Near-to-Mint deployment module used for this project within Blockscout’s badge framework.

Put together, N2MERC721A refers to a Near-to-Mint implementation of an ERC-721A NFT contract.

Method and Decoded Input

Blockscout automatically decodes the method being called.

Method ID: 0x00000000

Decoded input: swap_6269342730()

This function name is internal to the contract and was defined by the developer. It represents the function that handled the NFT mint.

For many ERC-721 mints, you may see method names such as:

- mint()

- safeMint()

- claimBadge()

Even when the function name looks arbitrary, Blockscout correctly identifies this transaction as a contract call rather than a simple transfer.

Value

0.0004 ETH (~$1.20)

This is the mint price paid by the user to create one Blockscout Buff Badge NFT.

Transaction Fee

0.0000005901 ETH (~$0.00185)

The total cost of this NFT mint was less than two cents, illustrating how Layer 2 networks make onchain interactions affordable.

Gas usage was approximately 65% of the limit, indicating efficient execution with sufficient headroom.

Gas, Fees, and Layer 2 Details

Because this transaction occurred on Base, the fee structure includes both Layer 2 execution costs and a small Layer 1 data posting fee.

| Field | Explanation |

|---|---|

| Gas price | 0.006669495 Gwei, significantly cheaper than Ethereum mainnet |

| Gas used | 88,436 (of 135,458 limit) |

| L1 gas used | 1,600, the amount of Ethereum mainnet gas required to publish Base’s rollup data |

| L1 fee | 0.000000000302311278 ETH (~$0.00000094), paid to Ethereum validators |

| L1 fee scalar | 0, no additional scaling applied |

Base batches many Layer 2 transactions together and submits them to Ethereum as a single proof. This is why you see additional L1-related fields when browsing Base transactions in Blockscout.

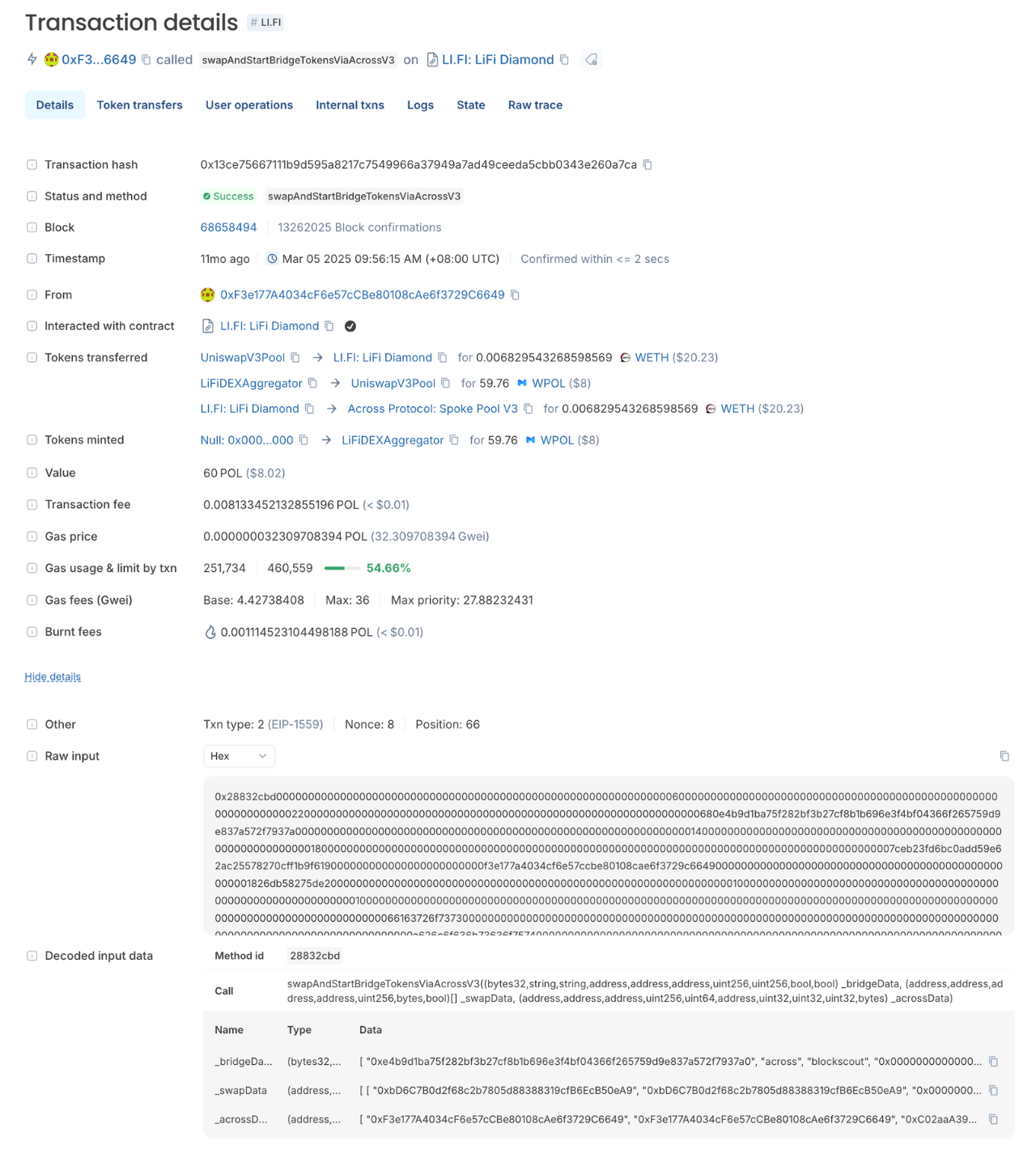

Example Complex Contract Interactions: Swapscout bridge

Transaction hash

0x13ce75667111b9d595a8217c7549966a37949a7ad49ceeda5cbb0343e260a7ca

About This Transaction

This transaction represents a cross-chain bridge initiated from Polygon to Ethereum using Swapscout, Blockscout’s integrated swap and bridge tool.

While the user performed a single action in the interface, bridging 60 POL to Ethereum, the transaction itself orchestrates multiple steps onchain:

- Token swaps on Polygon

- Contract-to-contract calls through an aggregator

- A bridge deposit into Across Protocol for settlement on Ethereum

This example is useful because it demonstrates:

- How aggregators bundle multiple DeFi actions into one transaction

- How swaps and bridges appear together in a single on-chain record

- How internal transactions and logs reveal hidden execution steps

- How Blockscout exposes complex contract behavior in a readable way

Line-by-Line Transaction Reading

Transaction Details

0xF3e177…6649 called swapAndStartBridgeTokensViaAcrossV3() on LI.FI: LiFi Diamond

This summary tells us that the user did not directly interact with a bridge contract or a DEX. Instead, they called a single high-level function on Li.Fi’s main aggregator contract.

In this specific case, the function name makes the intent explicit:

- swap indicates that a token exchange will occur on the source chain

- startBridgeTokens indicates that the resulting tokens will be deposited into a bridge

- ViaAcrossV3 specifies that Across Protocol is the bridge being used

This one function call coordinates all downstream actions, which explains why this transaction produces token transfers, internal transactions, and logs across multiple protocols.

Transaction Hash

This hash is the permanent identifier for the entire bridge initiation. It anchors every step of the process, from the initial swap on Polygon to the bridge deposit that will later finalize on Ethereum.

Status and Method

Status: Success

Method: swapAndStartBridgeTokensViaAcrossV3

A successful status confirms that all required steps completed without reverting. If any part of the swap or bridge preparation had failed, the entire transaction would have reverted.

The method name here is especially informative because it reflects how modern DeFi contracts expose high-level intent rather than low-level mechanics. Instead of calling separate swap and bridge functions manually, the user relies on the aggregator to execute a predefined workflow.

Block

Block: 68,658,494

Confirmations: 13,262,025

This transaction was included in a finalized Polygon block and has accumulated a very large number of confirmations. On Polygon, confirmations grow rapidly, reinforcing that the transaction is fully settled on the source chain.

While the bridge itself completes asynchronously on Ethereum, this block confirms that the Polygon-side execution is final.

Timestamp

Mar 05, 2025, 09:56:15 (+08:00 UTC)

Confirmed within: ≤ 2 seconds

The confirmation time aligns with Polygon’s average block time. Even though the transaction is complex, involving swaps and bridge preparation, it still settles almost instantly from the user’s perspective.

This highlights a key design goal of Layer 2 and sidechain environments: making advanced DeFi actions feel as fast as simple transfers.

From

This is the user’s externally owned wallet that initiated the bridge. All subsequent actions, including swaps and contract calls, are executed on the user’s behalf by smart contracts, but this address remains the originator of the transaction.

To

LI.FI: LiFi Diamond

This is Li.Fi’s primary aggregator contract. Rather than being the final destination of funds, this contract acts as a coordinator.

Blockscout tags this address as “Interacted with contract”, confirming that the user handed execution control to Li.Fi, which then routed the transaction through multiple protocols to complete the bridge.

Tokens Transferred

This section shows the actual movement of tokens that occurred as part of the transaction.

Reading these entries together reveals the execution flow:

- WPOL was swapped for WETH through Uniswap V3 pools via the LiFiDEXAggregator

- WETH was then transferred from Li.Fi to Across Protocol’s Spoke Pool

- Temporary token movements occurred internally to facilitate the swap

Although the user started with POL and intended to bridge value to Ethereum, the on-chain record shows that the bridge operates using WETH as the canonical asset.

Tokens Minted

Null → LiFiDEXAggregator (WPOL)

This mint event represents wrapped token mechanics rather than user-facing minting. The zero address indicates token creation, which occurs as part of internal accounting during the swap process.

These events are common in complex DeFi transactions and do not represent new assets being issued to users, but rather temporary representations used to complete swaps efficiently.

Value

60 POL (~$8.07)

This is the amount of value the user committed to the bridge. Even though the internal swaps involve WETH, this field reflects the original asset sent from the user’s wallet.

Transaction Fee

0.008133452 POL (< $0.01)

Despite executing multiple swaps and a bridge deposit, the total fee remains negligible due to Polygon’s low gas costs.

This illustrates why aggregators and bridges often operate on low-cost chains: they can bundle complex logic without imposing prohibitive fees on users.

Gas Price

32.309708394 Gwei

This gas price is typical for Polygon at the time and reflects network conditions rather than transaction complexity. On Polygon, even relatively high gas prices still result in very low absolute costs.

Gas Usage and Limit

Used: 251,734

Limit: 460,559

Usage: 54.66%

The transaction consumed just over half of the allocated gas limit. This indicates that the aggregator set a conservative limit to ensure all downstream calls could execute safely, while the actual execution remained efficient.

Gas Fee Breakdown (EIP-1559)

- Base fee: 4.42738408 Gwei

- Priority fee: up to 27.88232431 Gwei

- Burnt fees: 0.001114523 POL

This transaction follows the EIP-1559 fee model, where part of the fee is burned and part is used to incentivize validators. Even with multiple internal calls, the total burned amount remains minimal.

Decoded Input Data

Blockscout decodes the raw calldata into structured parameters, revealing how Li.Fi orchestrated the transaction.

At a high level:

- _bridgeData specifies the bridge protocol (Across), the application name (Blockscout), the source token, and the sender

- _swapData describes the swap routes, DEX pools, and amounts used to convert POL into WETH

- _acrossData defines the destination details, token amount, timestamps, and Across Protocol configuration

This decoded view confirms that Li.Fi bundled a swap and a bridge into a single atomic transaction, abstracting away the complexity from the user.

Altogether, this transaction demonstrates how a single user action can span multiple layers of the DeFi stack:

- A user interface (Swapscout)

- An aggregator contract (Li.Fi Diamond)

- A DEX (Uniswap)

- A bridge protocol (Across)

Blockscout exposes all of these layers in one place, allowing users to trace value movement, understand execution paths, and verify exactly how their assets were handled.

This is the practical value of a block explorer when dealing with modern, multi-step onchain interactions.