Blockscout Gas Tracker

Understand how gas fees work across Ethereum and L2 chains with the Blockscout Gas Tracker. Explore gas prices, limits, EIP-1559 fees, and real-time network load

Gas is how blockchains measure and charge for the computing power needed to run transactions and deploy and interact with smart contracts. Think of it like paying for fuel - the more complex the transaction, the more gas is needed to pay for things like processing power, memory, storage, and network usage.

Gas separates charges for resource usage from a blockchain's native coin, enabling precise operations and preventing abuse. Computation, storage, and bandwidth costs aren't tied to the coin's market price; instead, the network defines its own internal pricing mechanism. This allows the system to charge exact amounts for work performed and block malicious actors from DDOS-type attacks.

Gas trackers are tools that help visualize these dynamics. The Blockscout Gas Tracker allows you to monitor gas fees during both off-peak and high-demand periods across different chains. In this article, we explore how to use this tool and gain a better understanding of how gas fees work on Ethereum and other L2 chains.

How Gas works on Ethereum

Gas on Ethereum is a metering system that measures the computational work required to execute specific operations, such as sending a transaction or executing a smart contract function. Here's a breakdown of the key components and how they work together;

Gas Units

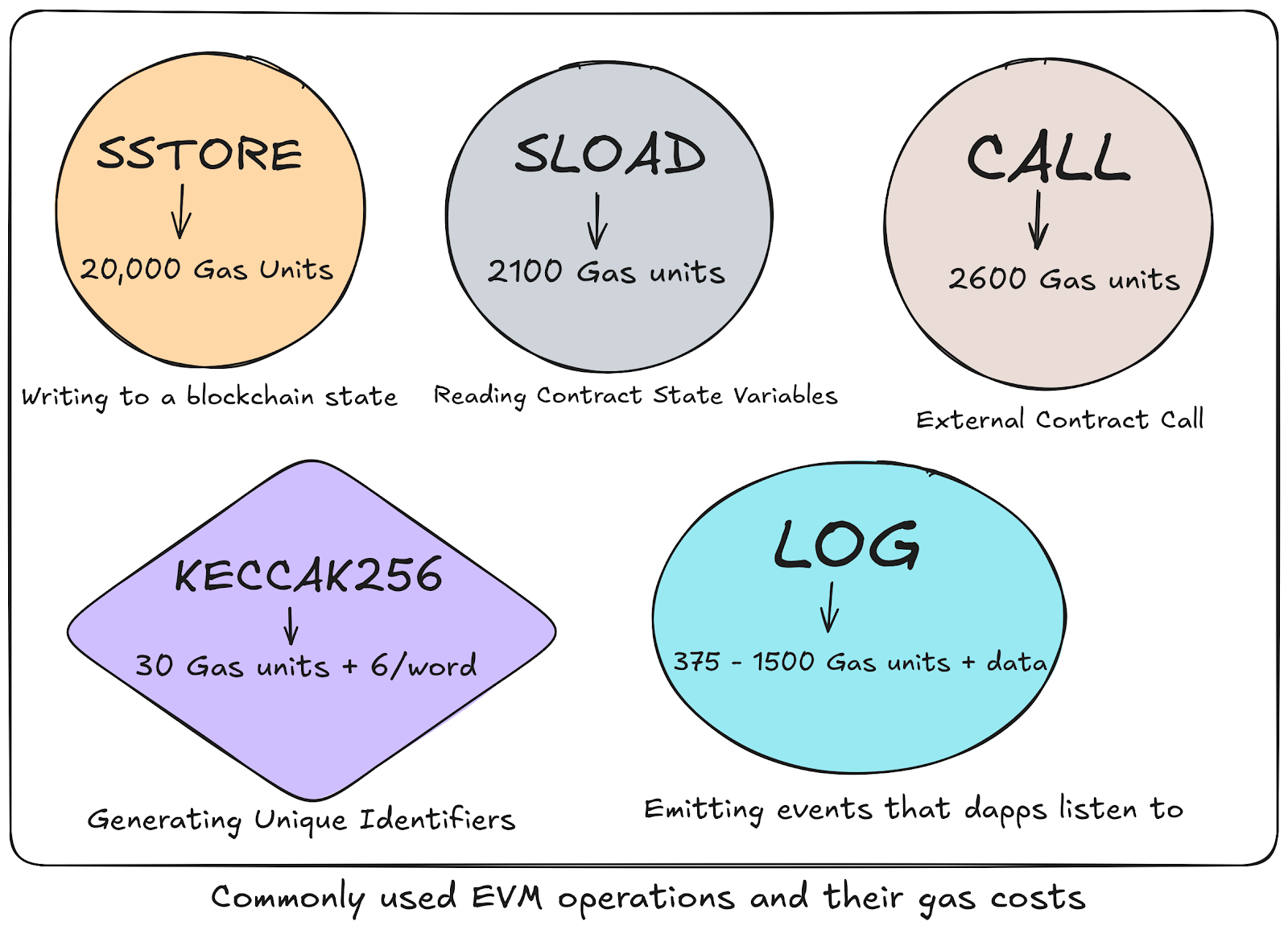

Every operation on Ethereum's Virtual Machine (EVM) is assigned a fixed cost in gas units, which reflects its computational complexity. A simple Ether transfer, for example, costs at least 21,000 gas units. More complex operations cost more.

DeFi operations, such as token swaps or lending protocols, execute dozens of EVM operations in sequence, resulting in significantly higher gas costs than for basic transactions.

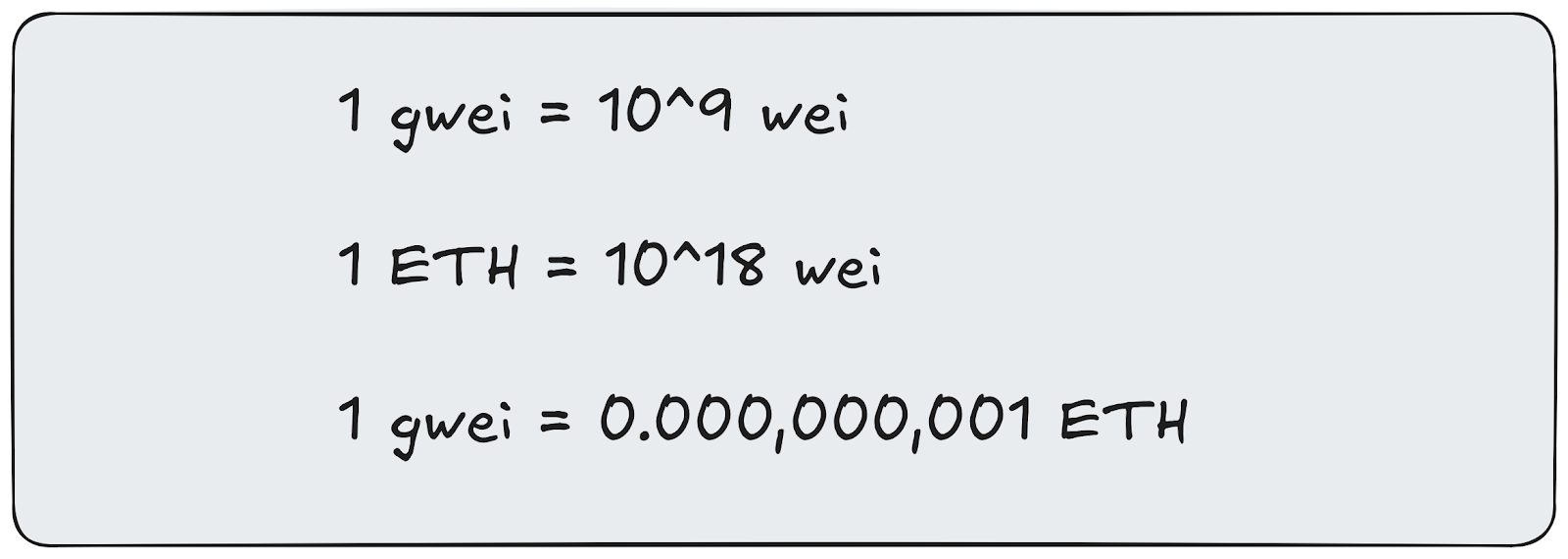

Gas Price

The gas price is how much you're willing to pay per unit of gas (measured in Gwei). While technical documentation often states that users set their own gas prices, in reality, this means something quite different. In practice, wallets like MetaMask, Coinbase Wallet, and others handle this complex decision automatically for users.

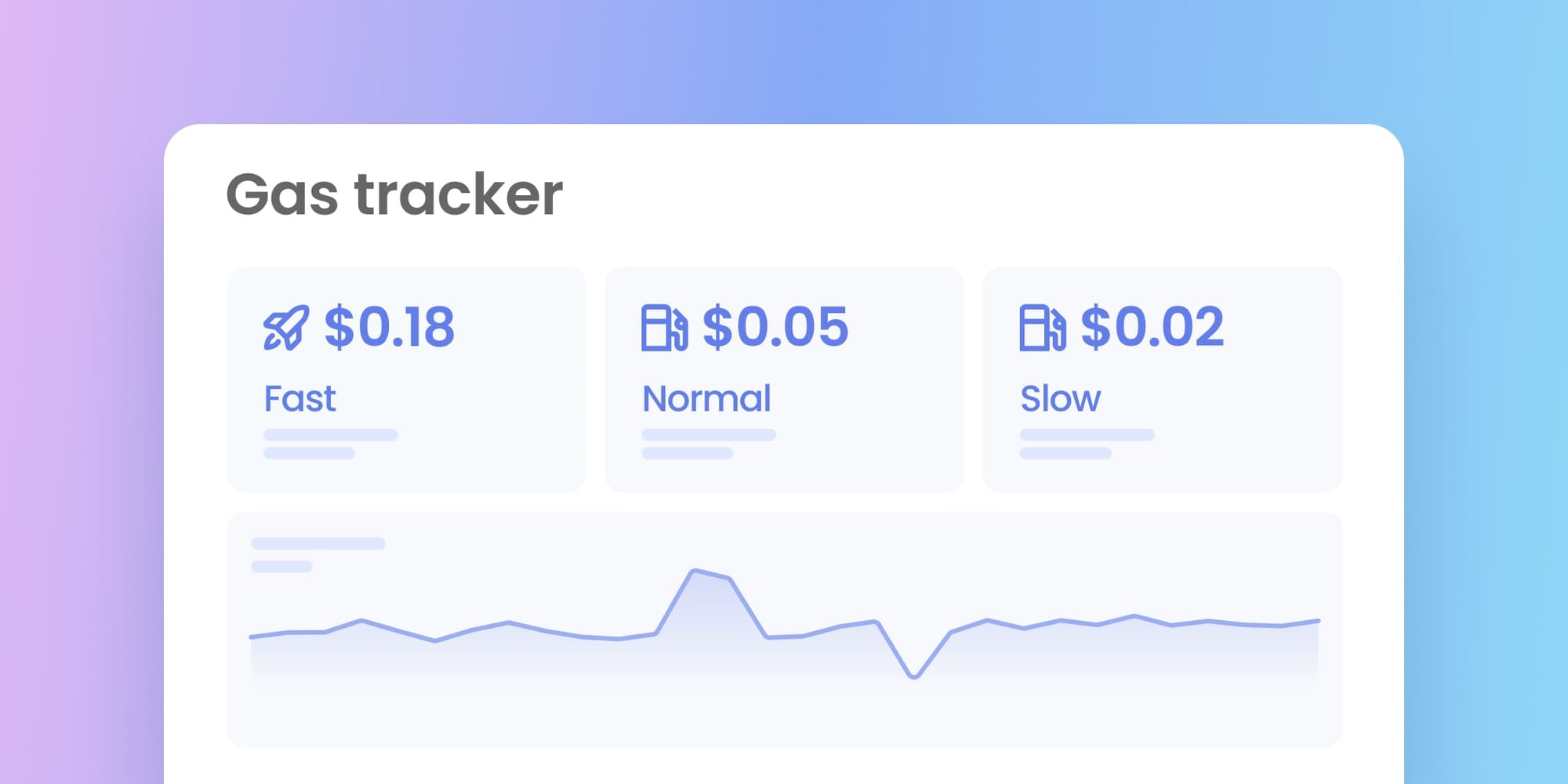

Wallets continuously query gas price APIs and analyze current network conditions to suggest appropriate pricing tiers, typically presenting them as simple "Slow," "Standard," or "Fast" options.

Most users never venture beyond these default suggestions. They see an estimated total cost in their local currency and click "Confirm" without understanding the underlying mechanics of the gas price. The few who do customize their gas prices are typically power users who click "Advanced" or "Edit" options during periods of extreme network congestion, manually setting higher prices to ensure faster transaction processing.

The Transaction fee, which is = Gas units × Gas price, remains accurate, but it's more precisely described as "Gas units × Wallet's suggested gas price = Transaction fee." This abstraction serves users well, as most people have no context for what "30 Gwei" means but can easily decide whether a "$5 fee" is acceptable for their transaction.

Gas Limit

This is the maximum amount of gas units you are willing to spend on the transaction. Gas limits require predicting exactly how much computation a specific transaction will need.

Wallets use simulation techniques to estimate gas limits. When you interact with a smart contract, your wallet performs a "gas estimation call", essentially running a dry simulation of your transaction against the current blockchain state. This simulation approximates the amount of gas the transaction will consume, and the wallet typically adds a safety buffer of 10-20% to account for minor state changes that may occur between estimation and execution.

For simple ETH transfers, this process is straightforward since the gas requirement is always exactly 21,000 units. However, smart contract interactions become far more unpredictable. A DEX swap might need 150,000 gas under normal conditions, but suddenly require 200,000 gas if liquidity shifts between your estimation and execution.

The consequences of incorrect gas limit estimation are more severe than gas price miscalculation. Setting your gas price too low means your transaction waits longer in the mempool, it may eventually be dropped, but you can resubmit with a higher price. Setting your gas limit too low can also cause your transaction to fail mid-execution, consuming all the allocated gas without completing the intended operation

The Modern Gas Fee Structure (EIP-1559)

The introduction of EIP-1559 brought a new fee structure where each transaction includes a base fee (burned, or permanently removed from circulation) and a priority fee (Tips paid to validators for faster transaction processing). Under the new system, users specify three key parameters when sending transactions:

- the maximum priority fee (your tip to validators),

- the maximum total fee (the ceiling for base fee plus tip combined),

- the gas limit (which remains unchanged from the pre-EIP-1559 system).

These parameters work together to provide both cost predictability and control over processing priorities. For example, if the current base fee is 25 Gwei and you set a maximum priority fee of 2 Gwei with a maximum total fee of 30 Gwei, your actual transaction cost would be 27 Gwei per gas unit (25 Gwei base fee plus 2 Gwei tip).

The maximum fee acts as a safety cap. If the base fee unexpectedly rises to 29 Gwei before your transaction is processed, you'll only pay a total of 29 Gwei, as your 2 Gwei tip would be reduced to 1 Gwei to stay within your 30 Gwei maximum.

While EIP-1559 introduced these sophisticated parameters, the user experience remained simple; wallets just got better at automatically managing the complexity. Most people still have no idea what "max priority fee" means.

Tracking gas prices Across Chains

Blockscout provides comprehensive support for a diverse range of blockchain networks. Its suite of tools and dapps includes a gas tracker that helps users monitor network fees. Let's explore how to use it across various supported chains. These example chains also use ETH for gas; however, a chain can use a different token (though units are still typically denominated in GWEI).

Ethereum

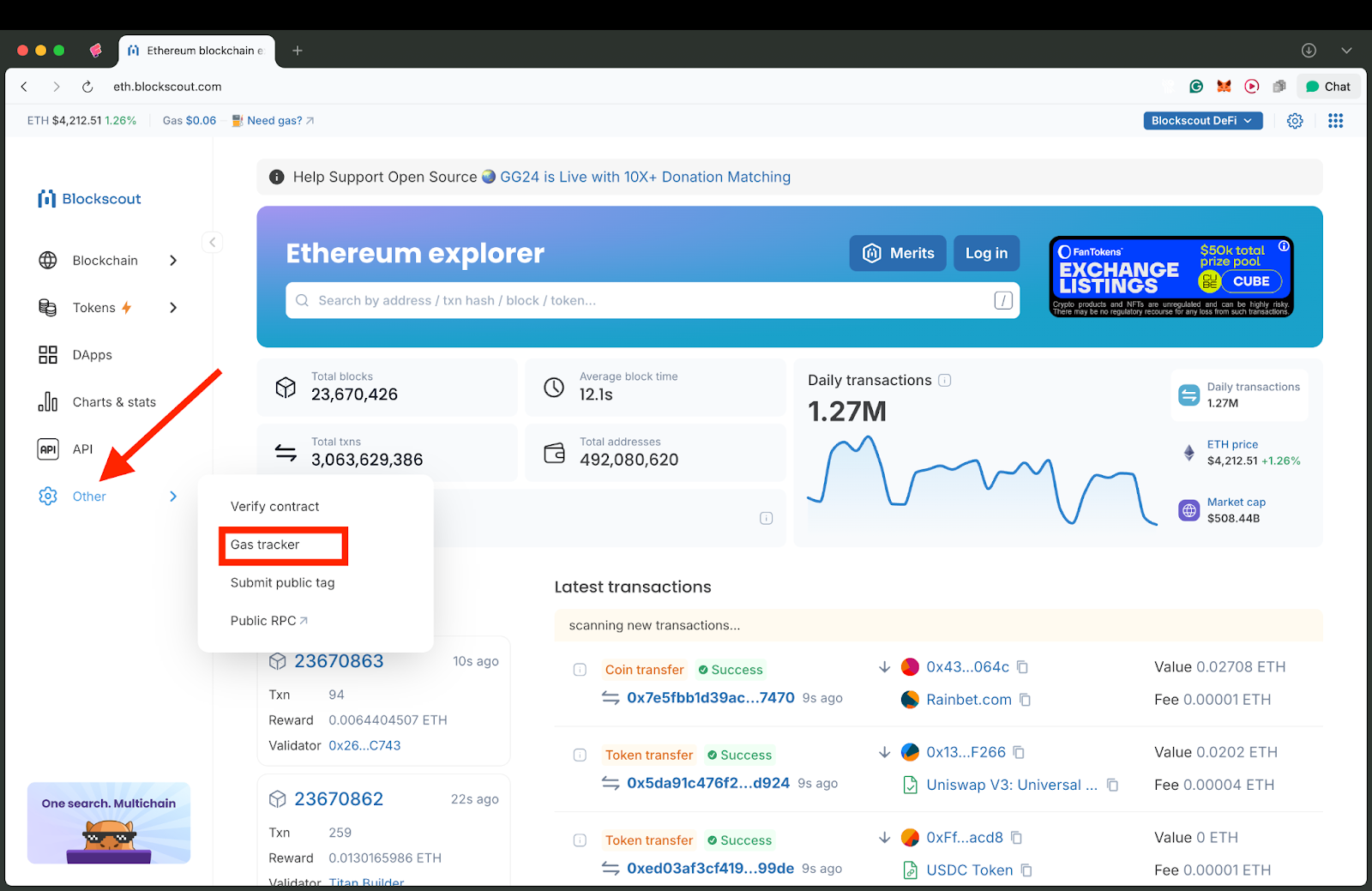

Go to the Ethereum Explorer, click Other, and select Gas Tracker.

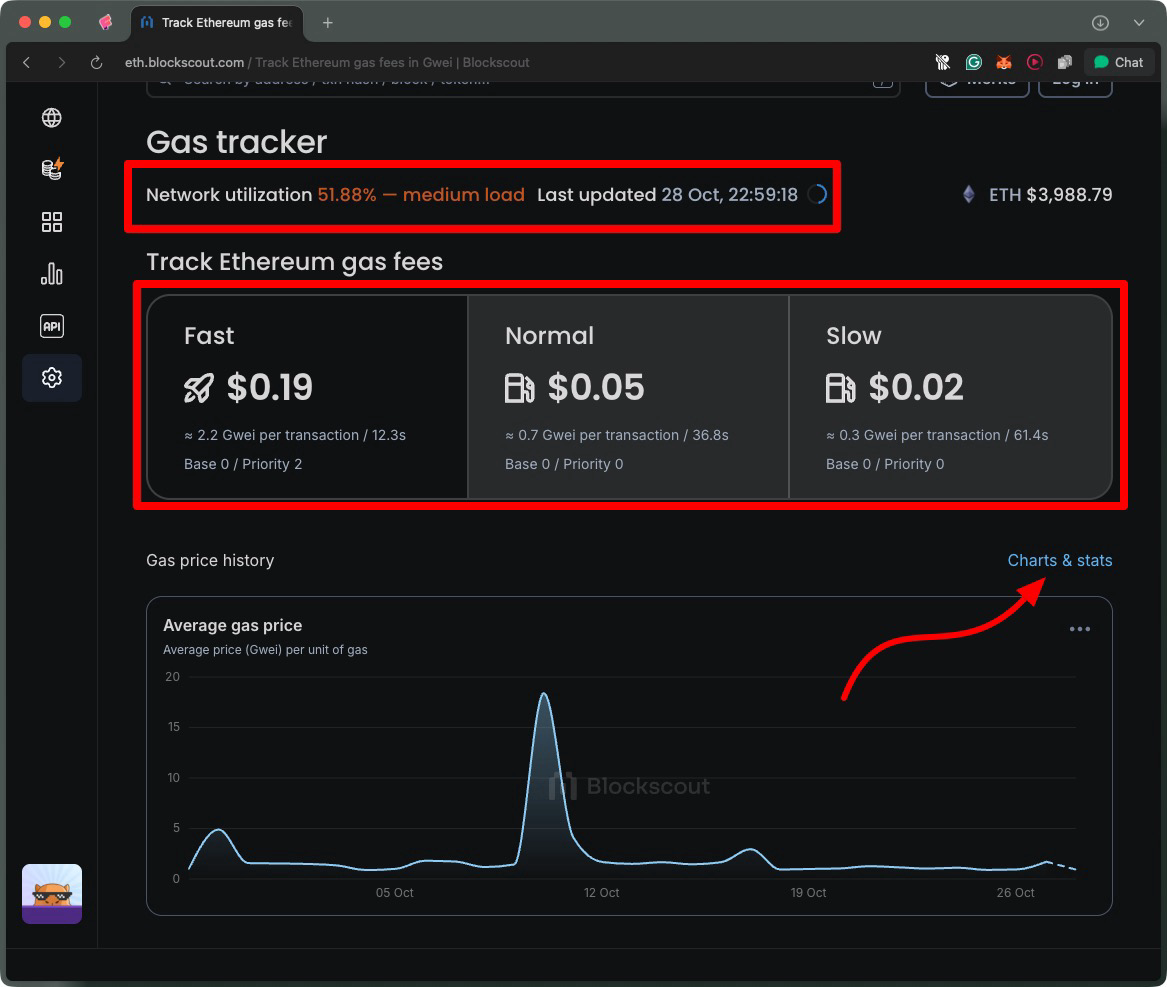

From what we see here, at 51.88% network usage, Ethereum is moderately busy, which explains why gas fees aren't extremely high right now.

Users can view fees relative to three speeds: Fast ($0.19, 12 seconds), Normal ($0.05, 37 seconds), or Slow ($0.02, 61 seconds). In this example, gas fees are very low. The current base fee is 0 Gwei, so users only pay small priority tips of 0.3-2.2 Gwei. Notice that even the fastest transactions cost under $0.20.

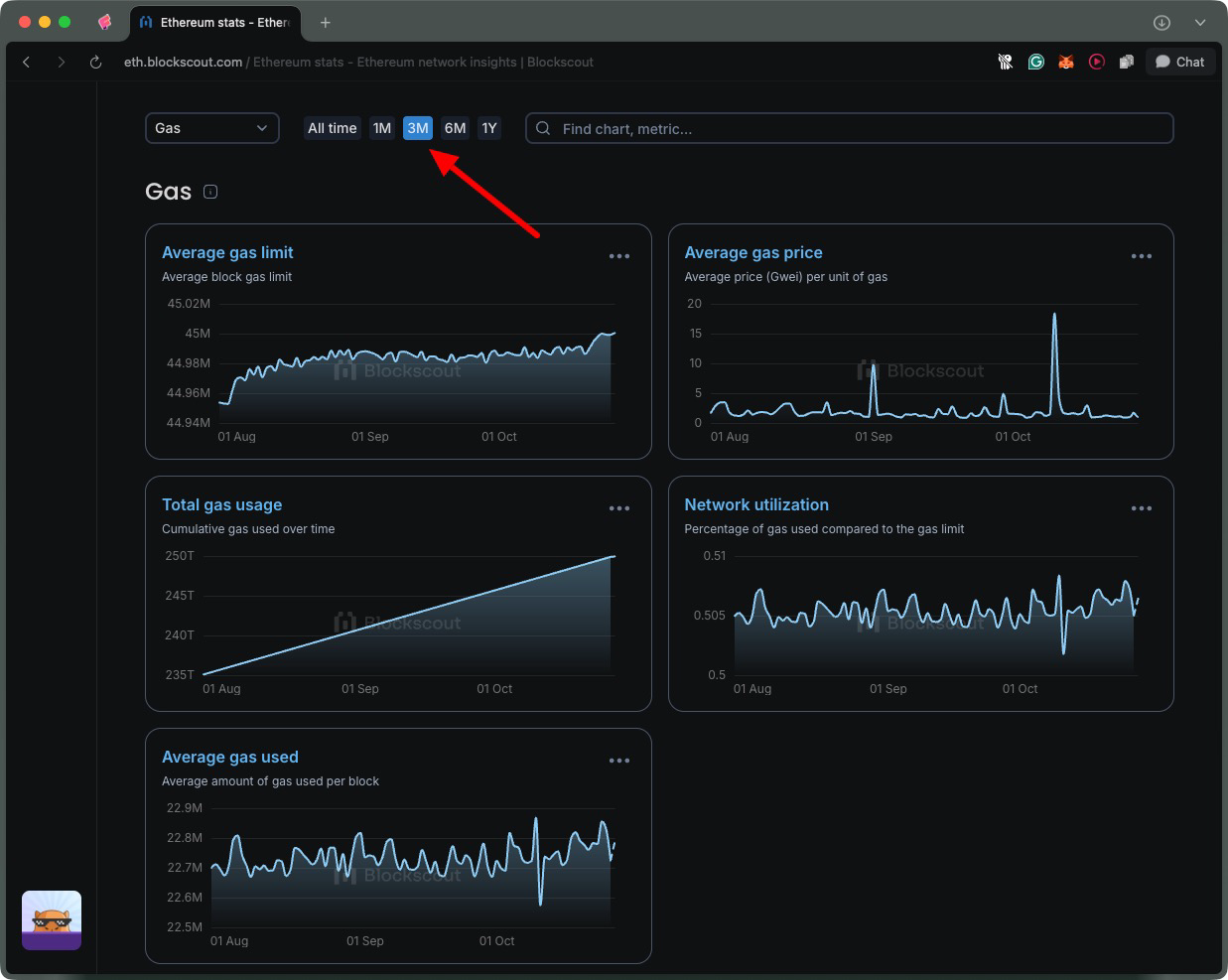

The gas price history chart reveals a dramatic spike around October 12th, reaching approximately 18-19 Gwei, followed by a return to sub-1 Gwei levels, demonstrating how volatile network fees can be (the October flash crash impacted many chains, as you will see in the following examples).

Worldchain

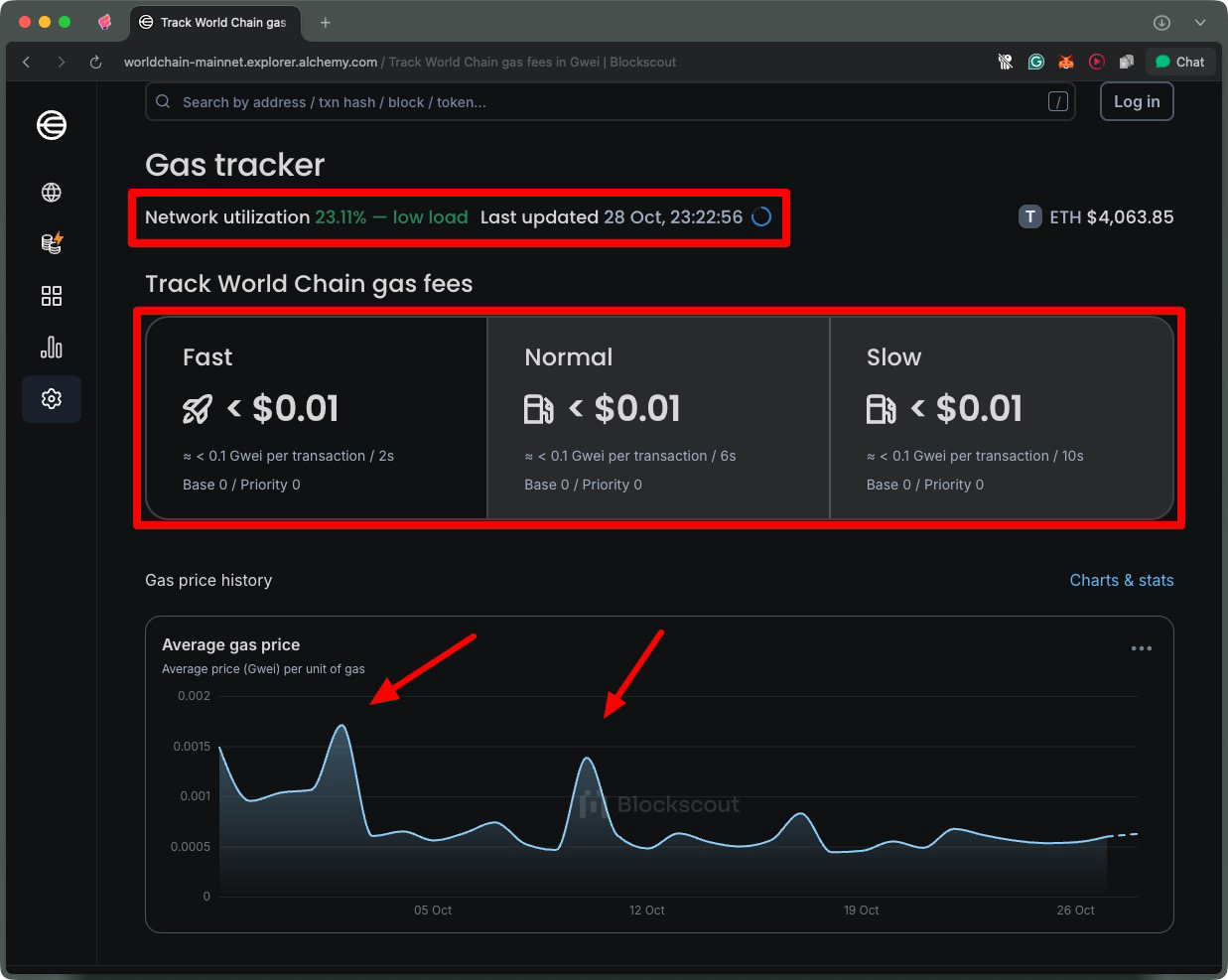

Looking at a different example, the Worldchain network shows 23.11% full with a "low load" status, with significantly less activity than Ethereum. All transaction fees are below $0.01, making World Chain much more affordable than Ethereum.

Even the slowest option takes just 10 seconds, while fast transactions confirm in only 2 seconds. Both base fees and priority tips are at 0 Gwei across all speed options, so users pay almost nothing to transact.

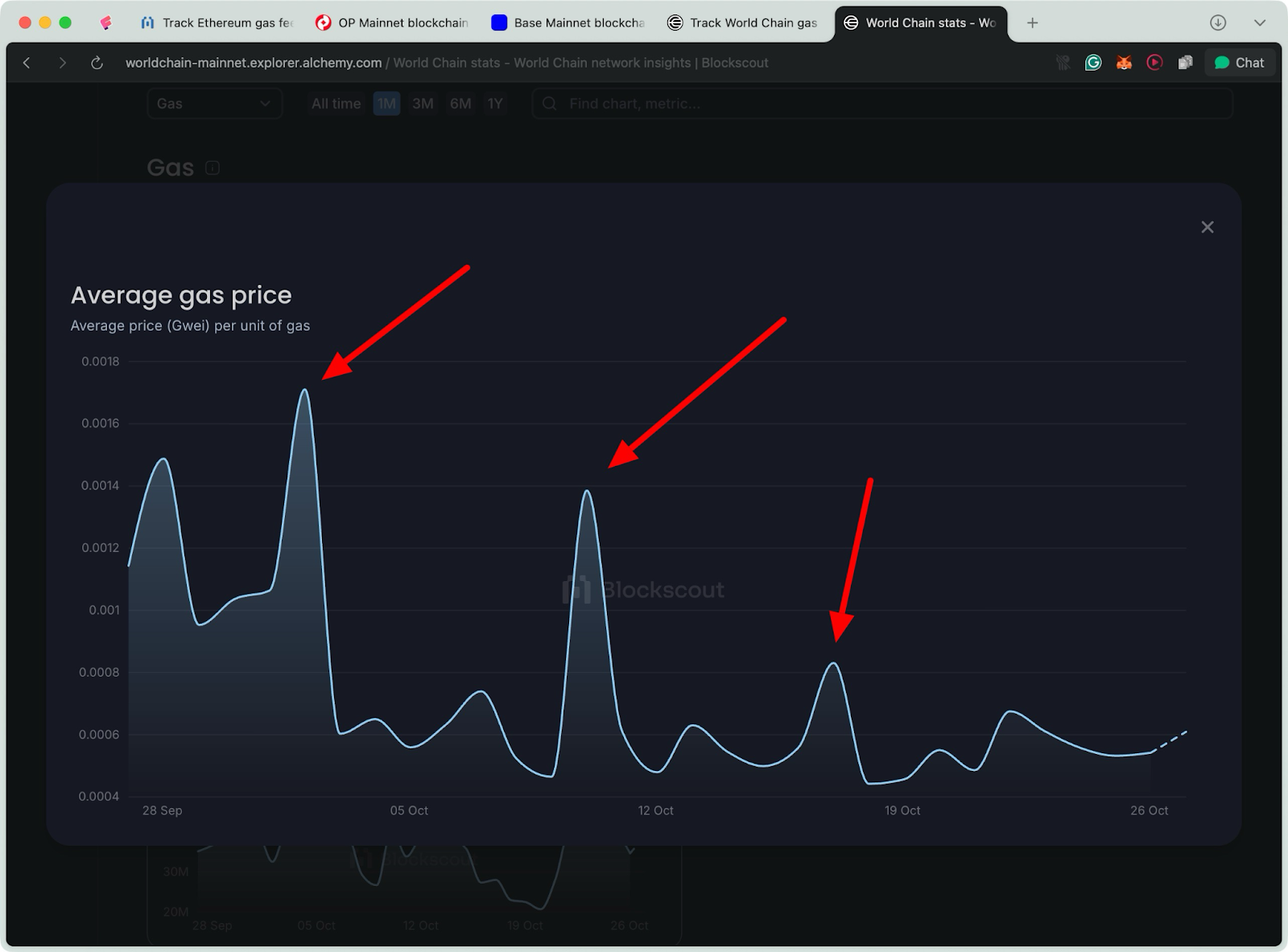

The gas price chart shows historically low fees, with the scale topping out at 0.002 Gwei compared to Ethereum's much higher levels. This highlights how Layer 2 networks like World Chain provide nearly free transactions with instant confirmations, addressing Ethereum's cost and speed issues.

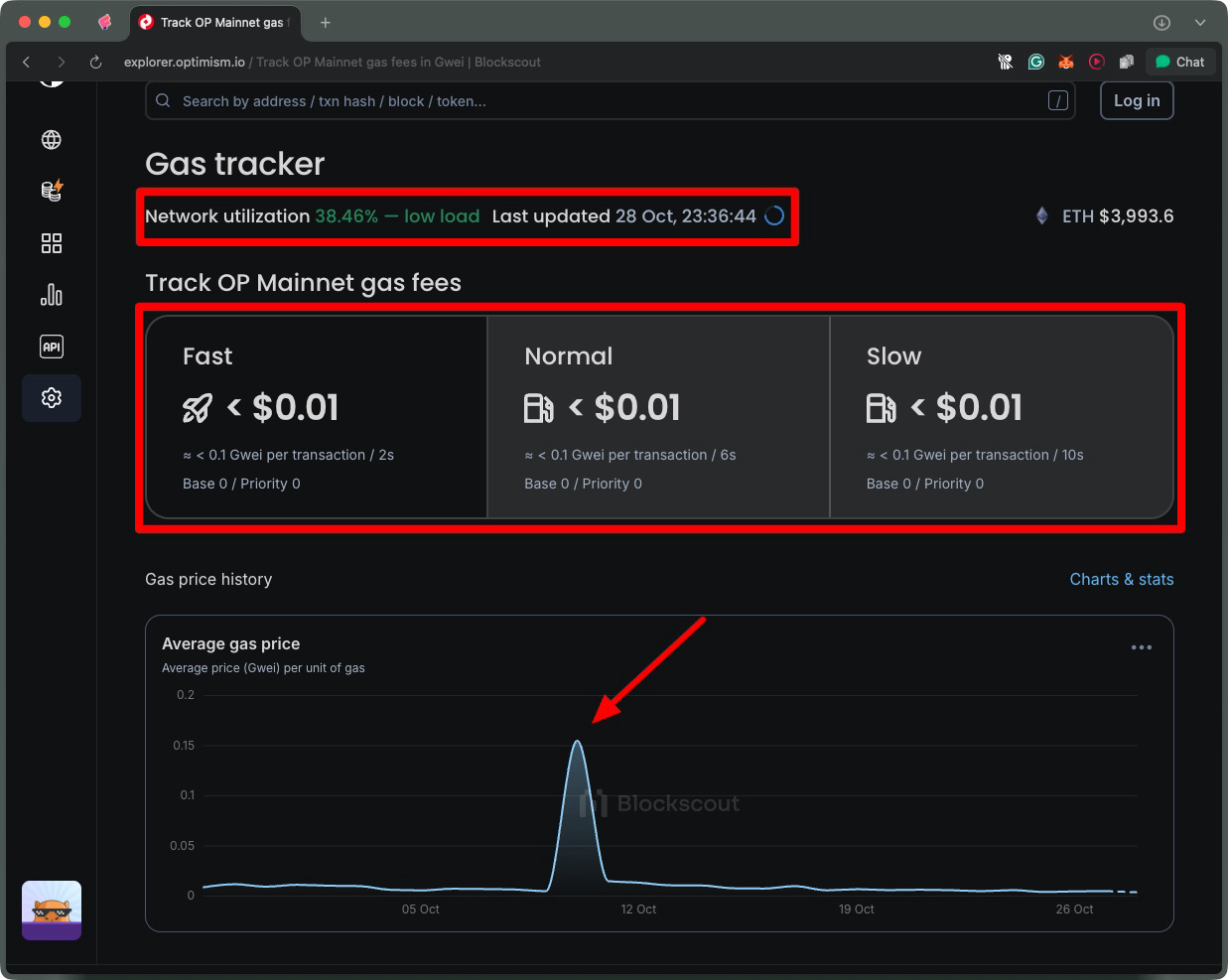

Optimism

OP Mainnet is running at 38.46% capacity with a "low load" status, indicating higher usage than World Chain, but still has ample room. All transaction speeds cost less than $0.01, maintaining the ultra-cheap Layer 2 advantage we observed on World Chain.

Transactions confirm within 2-10 seconds across all speed tiers, providing near-instant finality. Base fees and priority tips are both at 0 Gwei, so users pay almost nothing to transact.

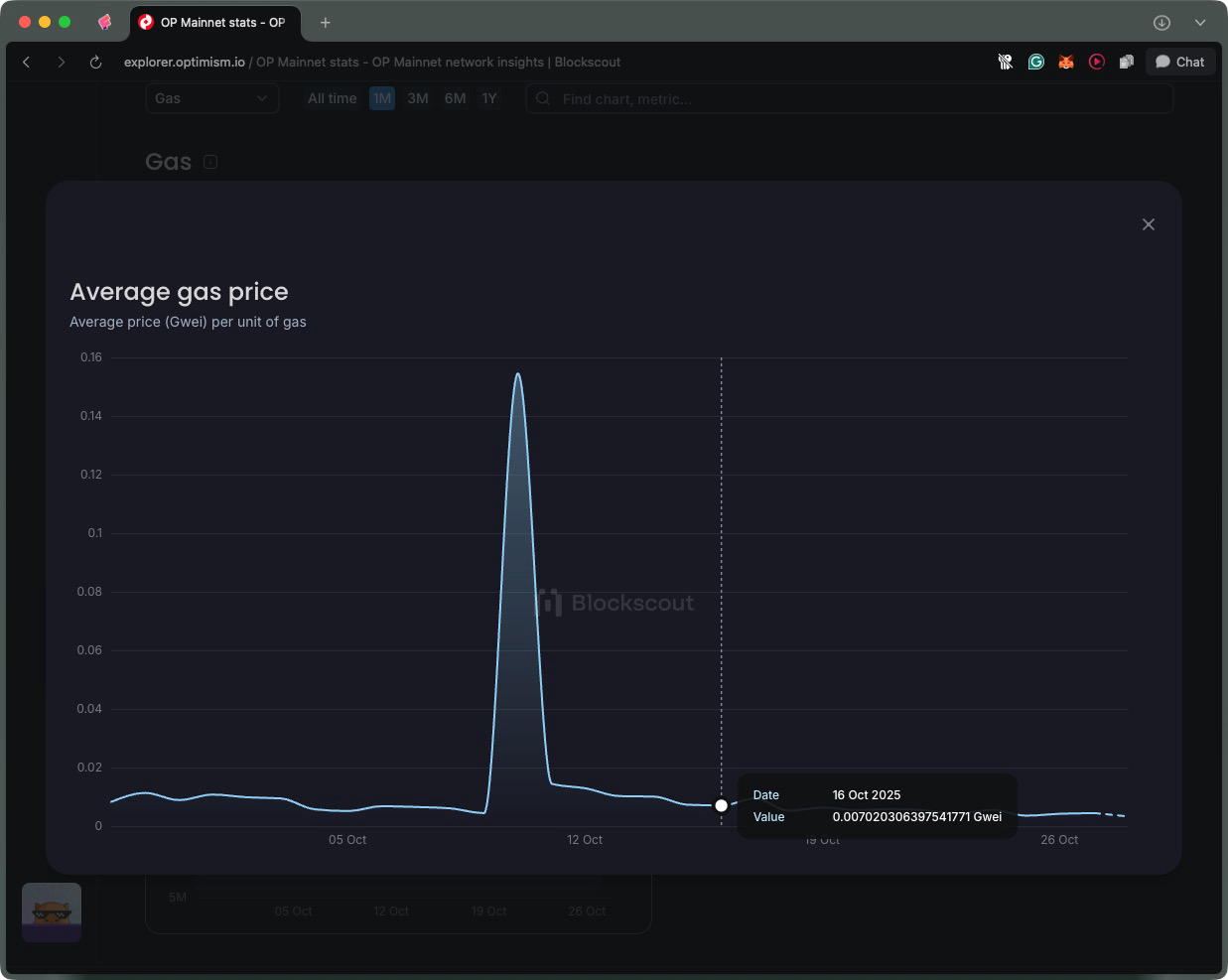

The chart shows a sharp spike around October 12th, reaching about 0.15 Gwei. The spike was brief and quickly returned to baseline levels, showing OP Mainnet efficiently managed the congestion. Aside from that spike, OP Mainnet maintains consistently low fees near zero, similar to the stability seen with World Chain.

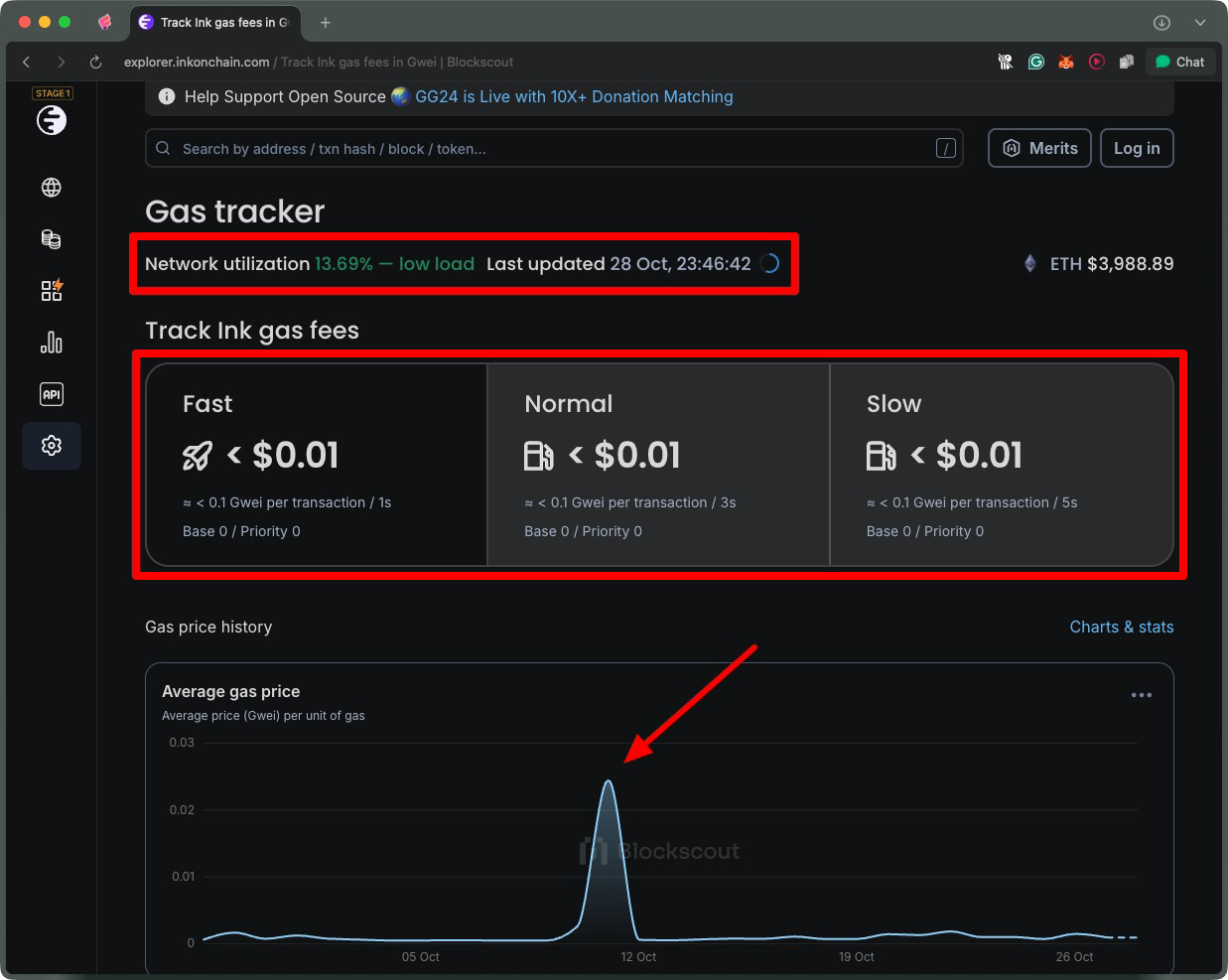

Ink

Ink chain runs at only 13.69% capacity with "low load" status, showing even less activity than the other Layer 2 networks we've seen. Confirmation times are speedy, just 1 second for fast transactions and 5 seconds for slow ones.

All transaction speeds cost under $0.01, maintaining Layer 2's ultra-cheap fees. Both base fees and priority tips are at 0 Gwei across all options, meaning users pay virtually nothing.

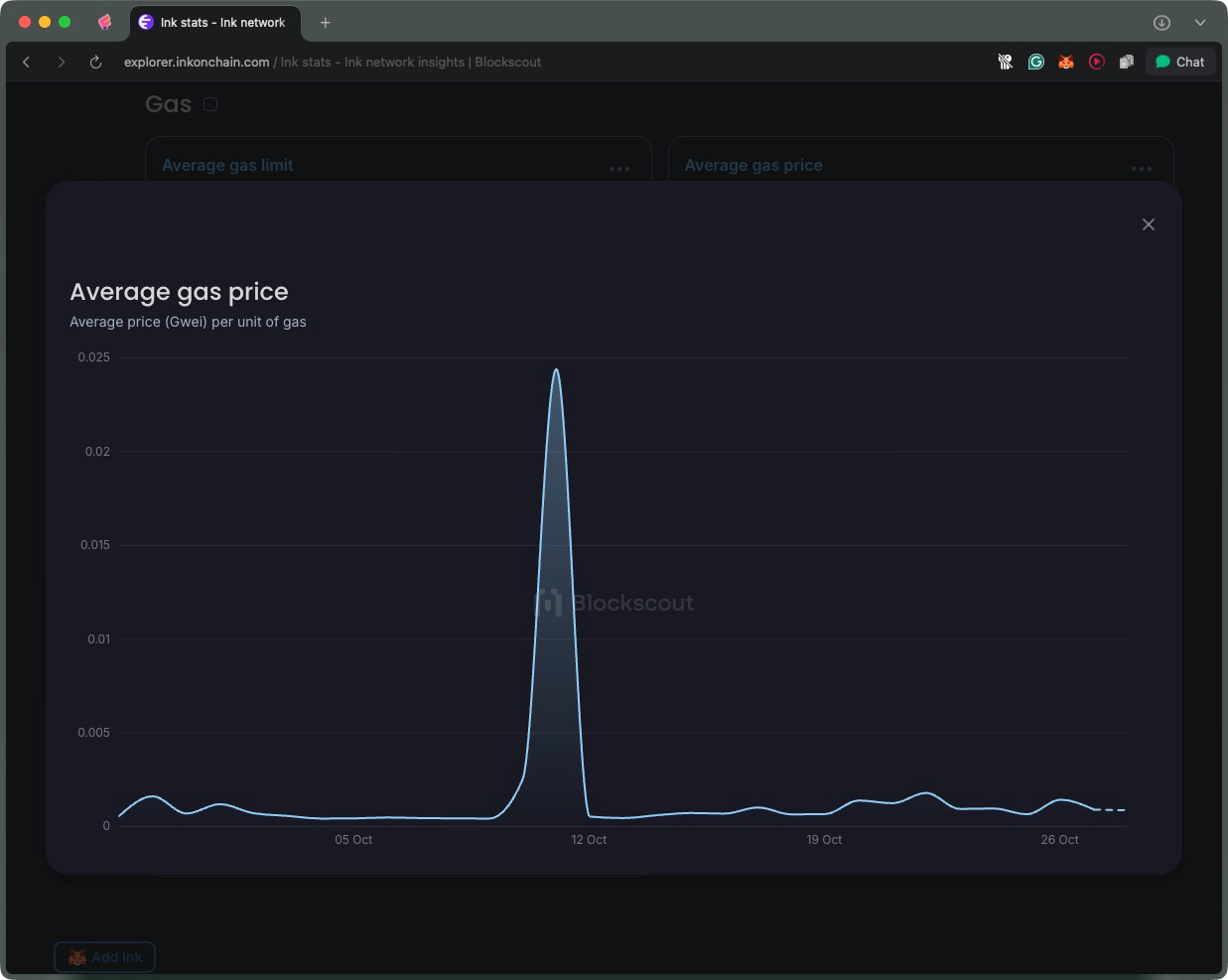

The chart shows consistently flat fees near zero with just one tiny spike around October 12th, reaching 0.025 Gwei. Like OP Mainnet, Ink also had a small spike on October 12th, suggesting some cross-network activity or event affected multiple Layer 2s.

Conclusion

Understanding the dynamics of gas fees in various blockchain networks shows how wildly costs can differ. Ethereum can incur extremely high fees when demand is high, whereas Layer 2 solutions like Worldchain, Optimism, and Ink typically offer low-cost transactions that confirm almost instantly.

Looking ahead, emerging innovations like gas sponsorships and paymaster systems promise to eliminate user-facing gas fees on Dapps and enterprises, covering transaction costs to create seamless user experiences. We will explore this further in upcoming articles.